Welcome back to RE: Indy, and Happy New Year! If you are like me, you are now settled back into the real world and thinking about all that is to come in 2026. I hope you had a great holiday season and a real chance to reset. I am back from Japan, South Korea, and California feeling grateful, recharged, and excited heading into the new year.

Before getting into the market, I want to say thank you to my team at Roots for holding things down while I was away for much of December. Their support made it possible, and to the clients who worked with me while I was gone, thanks for the patience, its amazing what can be accomplished from the other side of the world.

As we look toward 2026, it is worth zooming out. Our local market feels steady right now. Not overheated, not distressed. Indianapolis continues to offer something valuable: stability and actionable entry points. That combination is where thoughtful investors tend to do their best work.

What kind of portfolio are you trying to build? Cash flow matters, but so does durability. Some investments are designed for momentum, others for resilience. Align the strategy with your time horizon, your risk tolerance, your holding capacity, and in the end, the kind of life you are trying to build through your portfolio.

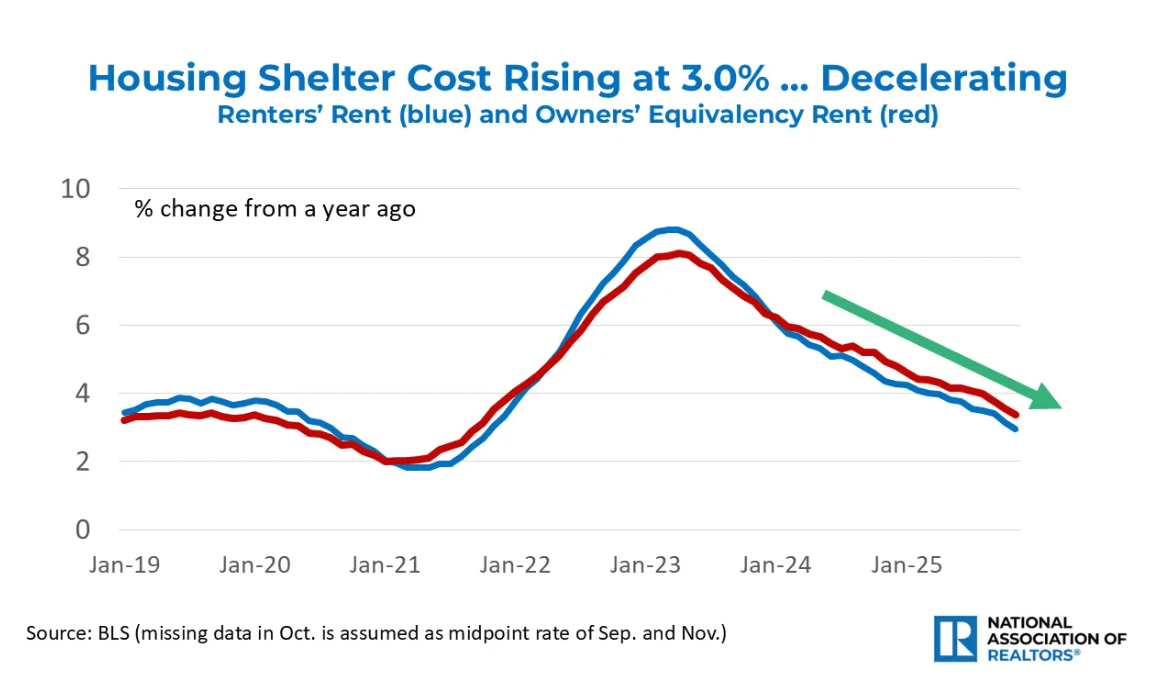

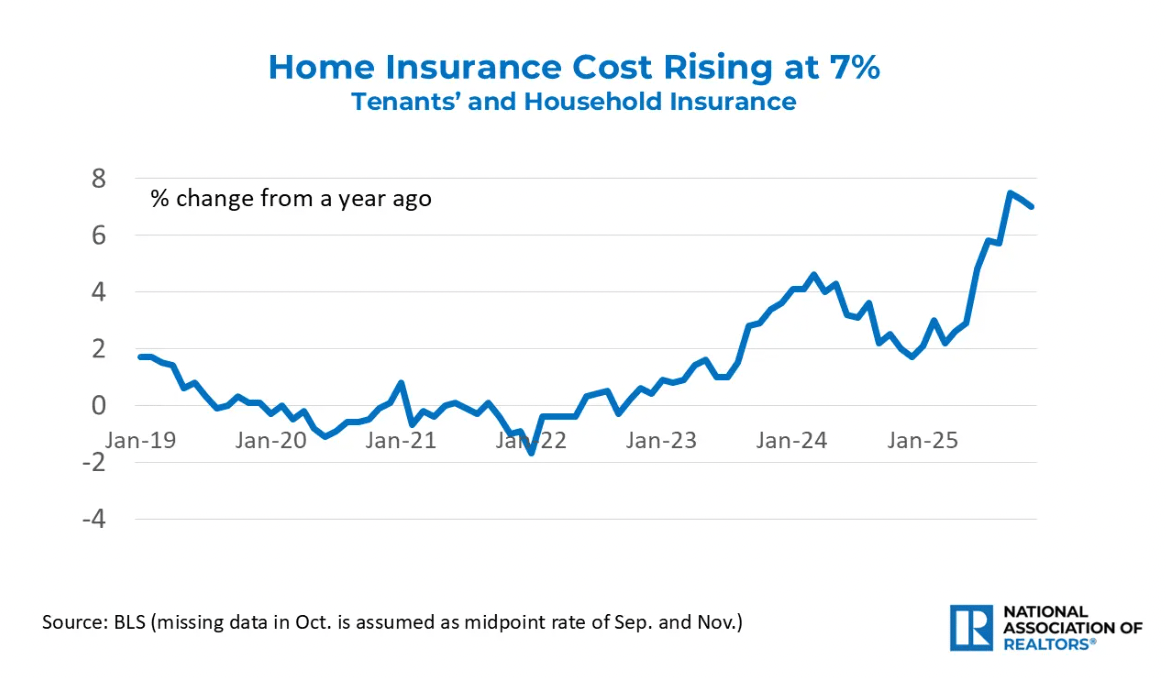

The data shows inflation continues to cool, but is still hanging above the Feds 2% target, with overall consumer prices moderating and shelter costs rising at their slowest pace in more than four years. Housing is playing a meaningful role in easing inflation pressure, even as insurance costs continue to climb and offset some of that progress.

Markets move in patterns, but they almost never replay the same script. Each cycle reshapes itself in response to new forces, new constraints, and new behavior. Bull markets and corrections both tend to surprise. History can offer perspective, but it rarely provides a blueprint. That is why the most important decisions right now are less about short term moves and more about positioning yourself correctly for whatever comes next.

Seen through that lens, the cycle we are in becomes less of a puzzle to solve and more of a filter. It forces better questions.

When the market shifts again, what do you want to already have in place? What needs to change this year to make that positioning possible?

If you want to think this through together, I would genuinely welcome the conversation. Reply to this email, text me or call me and let me know what you are aiming for in 2026.

My role is not to predict the future (I can’t), but to help you make sound decisions inside the market we actually have, using every tool and perspective we can muster. Indy is full of opportunity today, it might be different than what was available five, ten, or twenty years ago, but understanding that shift is exactly where educated investors can find their edge.

With that in mind, here is what I am seeing that can be acted on today.

Just one last plug

I’m aiming to grow this email community to include both investors and traditional homebuyers. Please consider sharing with anyone you think would enjoy or benefit.

If this isn’t your thing, feel free to unsubscribe anytime — no hard feelings.

Deals Worth a Closer Look

North Indy Metro MultiFamily Portfolio - OFF MARKET

5 properties | 17 units

$790,000

Looking to jumpstart your portfolio?

This collection of units gives an investor real scale right out of the gate. Instead of piecing together one property at a time, you step into a renovated, mostly stabilized collection spread across Anderson, Alexandria, and Muncie, all markets with reliable rent demand and steady year round occupancy. Most units have already been updated, the rent roll is strong with clear room to grow, and the distressed Proud Street duplex adds one more lever for upside if you like value add.

It is uncommon to find this many units, this clean, at a number that still leaves room for cash flow and long range appreciation. If you are looking to level up your holdings quickly and sensibly, this one is worth a closer look.

Priced at $790,000, this is the kind of bulk acquisition that rarely stays available for long.

1502 Spann Ave, Indianapolis, IN 46203

Single family | 4 bed | 2 bath | 1288 sqft

$260,000

Why I Like It »»

Operational Flexibility:

Being modeled with property management, owner operation in the first year can materially improve cash flow and bring the property close to breakeven for a single-family rental.

Proven Fountain Square Location:

Corner lot in a high-demand Fountain Square pocket with strong rental appeal driven by walkability, downtown access, and neighborhood momentum.

Newer Build = Lower Friction:

Built in 2009, this home offers modern systems and a practical layout, reducing maintenance risk compared to older nearby inventory.

4-Bedroom Rent Flexibility:

Four bedrooms widen the tenant pool and support solid rent stability, especially for roommates or work-from-home households.

Clean Investor Fit:

A straightforward, low-maintenance rental with stable demand and long-term upside in one of Indy’s strongest urban submarkets.

The Numbers »»

Purchase Price | Down Payment | GMR |

|---|---|---|

$250,000 | %25 » $62,500 | $2000 |

Vacancy | Maintenance | CapEx | Management |

|---|---|---|---|

5% | 5% | 5% | 10% |

The Play »»

Target Entry:

Open at $235,000. At list, year one cash flow is negative with full service property management. This entry point creates breathing room, reflects single-family rental economics, and improves the path to breakeven. Expect to meet in the middle, but buyers have a strong position at this moment in the cycle.

Stabilize with Control:

Self-manage in year one to keep expenses tight and operate near breakeven. Focus on clean tenant placement and minimizing turnover rather than pushing rent aggressively.

Let Time Do the Work:

This is a long-term hold in a growing Fountain Square pocket. Rent growth, loan paydown, and appreciation compound steadily once the property is stabilized.

Maintain Flexibility:

After that stabilization, you retain optionality to continue self-managing, transition to property management as rents rise, or exit into a strong resale market.

1730 S State Ave, Indianapolis, IN 46203

Single Family | 2 bed | 1 bath | 704 sqft

$139,999

Why I Like It »»

Simple, Manageable Entry: The price point keeps the downside contained and makes this an accessible way to get positioned without forcing the numbers or overcomplicating the strategy.

Fully Updated and Rent Ready: With the major upgrades already complete, this home should command a more premium rent for the area and avoid the typical first year maintenance drag.

Utility Where It Matters: The fenced backyard and two car garage add real, everyday value. These are features tenants notice and tend to stay longer for, especially in an urban setting.

Location That Carries Demand: Minutes from downtown, Fountain Square, parks, and the Red Line, this pocket benefits from proximity driven demand that is practical rather than speculative.

Investor Fit: A strong option for someone who wants a straightforward, low friction rental with steady appeal and long term neighborhood upside, not a heavy value add project.

The Numbers »»

Purchase Price | Down Payment | GMR |

|---|---|---|

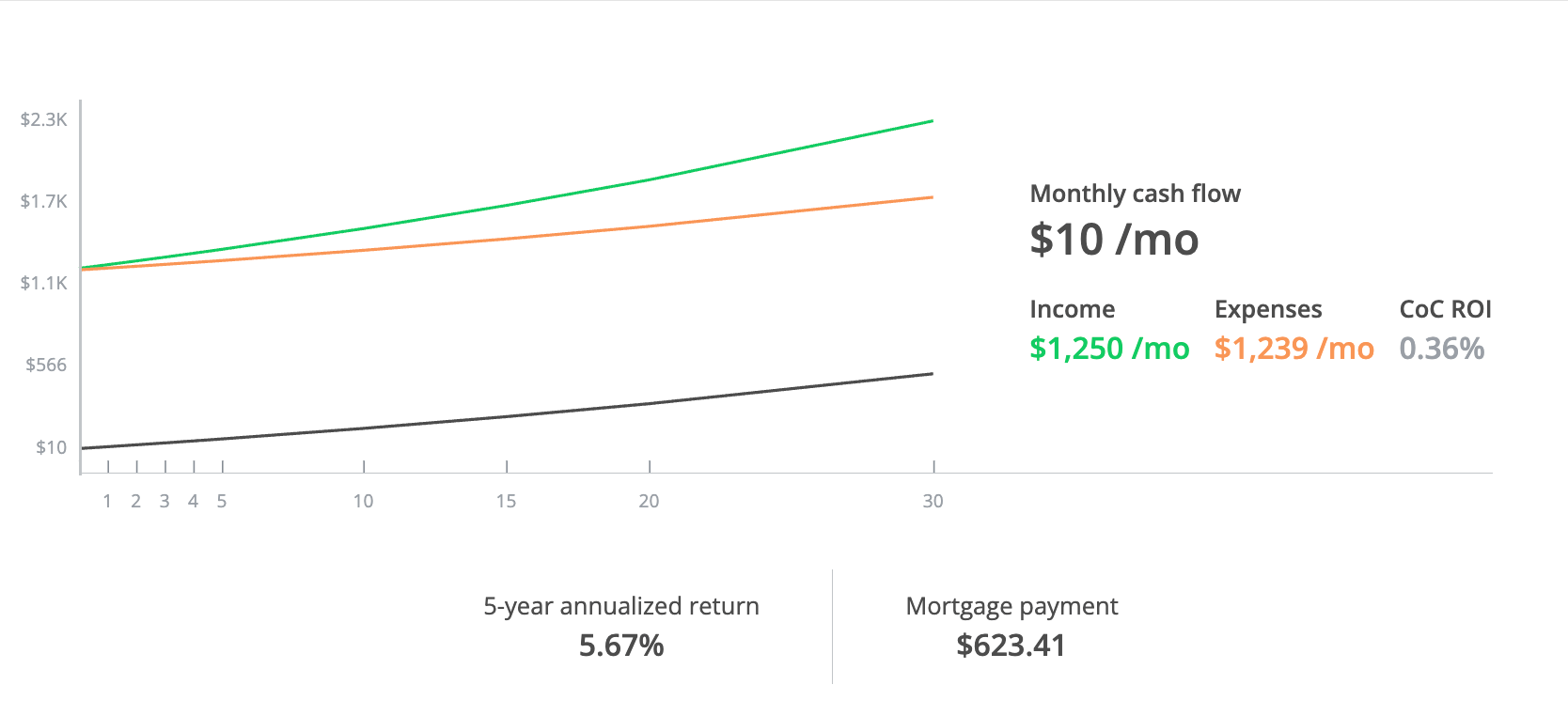

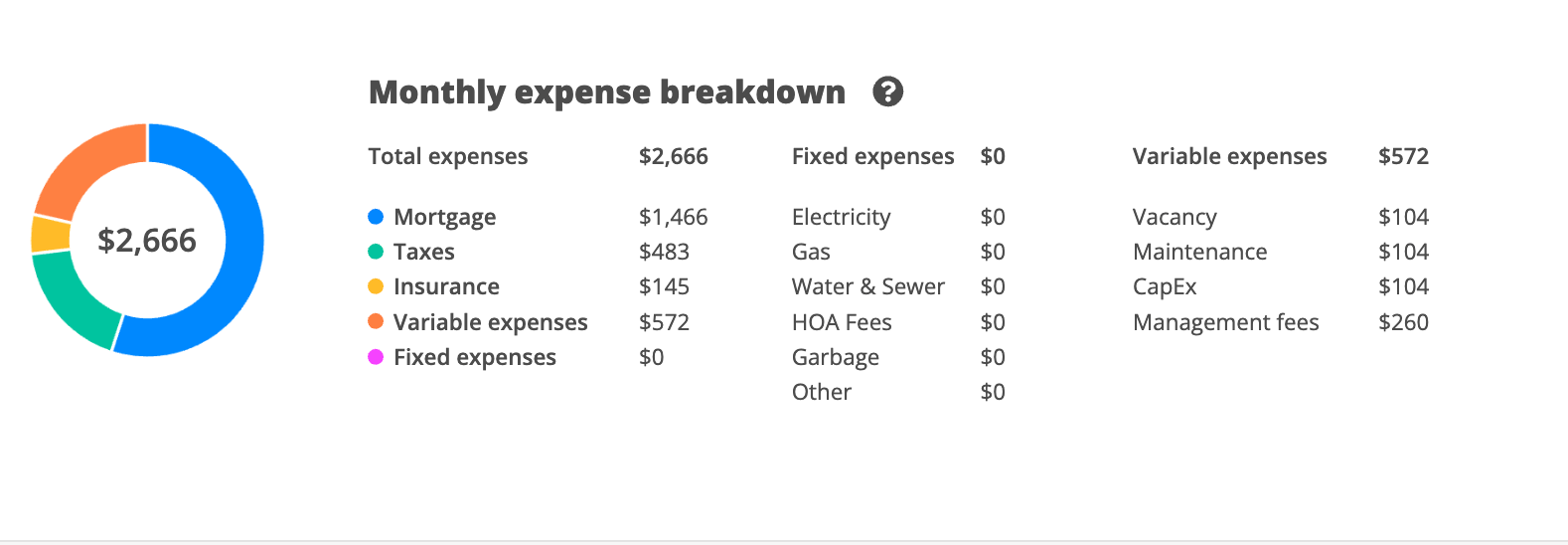

$135,000 | %25 » $35,000 | $1250 |

Vacancy | Maintenance | Capex | Management |

|---|---|---|---|

5% | 5% | 5% | 10% |

The Play »»

Open Around 130K: With extended days on market and a current list at 139,999, an opening offer around 130 gives you room to negotiate while staying grounded in today’s rental math. Expect a counter, but this sets a smart anchor for a clean, serious offer.

Underwrite Conservatively: The cash flow assumptions already bake in conservative expense modeling, including a full ten percent property management fee. That matters. If you self manage or optimize expenses over time, the deal only improves from there.

Buy for Stability and Simplicity: This is not a forced appreciation play. The strategy is to lock in a clean, upgraded asset at a reasonable basis, place a quality tenant at a premium-for-the-area rent, and let steady demand and long term neighborhood improvement do the work. Keep it simple, manage it well, and let time compound the outcome.

2336/2342 E 500 N Greenfield, IN - OFF MARKET

Duplex | 6 bed | 2 bath | 2460 sqft

$320,000

Why I Like It »»

This duplex stands out because it performs across multiple rental strategies. It is fully renovated, sold furnished, and has documented peak gross income that rivals many urban short term rentals. The location just outside Greenfield positions it perfectly for steady, needs-based demand from traveling nurses, insurance placement, and temporary workers, which makes the income stream less sensitive to trend cycles.

AIRROI data for the Greenfield market shows that strong listings can command above average daily rates with healthy annual revenue potential. That aligns with the property’s historical performance and suggests room to optimize through dynamic pricing, medium term stays, or a hybrid model.

The asset comes with newer systems, recent HVAC replacements, thoughtful finishes, and sits on a full acre, which adds long term stability beyond the rent roll. The downside is defined. If short or medium term demand softens, the property still underwrites as a long term rental at a reasonable basis.

The smart approach is to underwrite conservatively and view the higher Airbnb months as upside, not the floor. With both units vacant, you get a clean slate to stabilize, set pricing, and build a predictable runway. Returns improve meaningfully with active oversight, so this is best for an investor who wants adaptability, resilience, and a well executed asset that can perform across market cycles.

3411 Brookside Pkwy S Drive, Indianapolis, IN 46201

Duplex | 4 bed | 2 bath | 2188 sqft

$290,000

Why I Like It »»

Strong Rental Foundation: One side is already leased at 1,295, giving you day one income and flexibility on how to use the second unit.

Attractive Brookside Location: Directly across from Brookside Park, offering walkability, green space, and strong tenant appeal.

Solid 1920s Character: Brick exterior, covered porch, and practical layouts with peninsula kitchens and two bed two bath setups on each side.

Cash Flow Potential: With one side near market rent and the other ready to lease, you can build a solid rent roll quickly in a pocket that keeps gaining traction.

Investor Fit: Great for anyone wanting a stable, well located duplex with income growth potential and long term upside near a major city park.

The Numbers »»

Purchase Price | Down Payment | GMR |

|---|---|---|

$290,000 | %20 » $58,000 | $2600 |

Vacancy | Maintenance | CapEx | Management |

|---|---|---|---|

4% | 4% | 4% | 10% |

The Play »»

Open in the Mid 270s: The pro forma at the full 290 price shows thin year one cash flow with a slightly negative monthly position once all expenses are counted. Opening at 270 to 275 reflects the current income and the work required to stabilize the vacant unit. Expect a counter and plan to meet somewhere between your offer and the list.

Stabilize Quickly: With one unit already at 1295 and the second unit open, you can reset the rent roll fast. This neighborhood can support steady rent growth over time. Your goal is to lock in strong tenants early to build toward long term performance.

Buy for the Long View: If you can buy it under ask, year one improves and the long view gets even stronger. Cash flow, equity, and loan paydown grow steadily over the next decade, with meaningful performance showing up early. It is a classic buy and hold in a rising pocket where a smart entry and a solid rent roll create real long term value.

7590 S 25 E, Pendleton, IN 46064

Single Family | 5 bed | 6 bath | 13,521 sqft

$1,525,000

Bonus »»

This sits in the Pendleton area where space, privacy, and a slower pace still exist, but daily life is not disconnected from the city. The setting is a big part of the appeal. Room to spread out, a generous yard, and that quiet rural feel. Inside, the home feels comfortable and functional, with updates that make it easy to live in without losing its character.

It is fun to see a property that reminds you why so many people are drawn to Indiana real estate in the first place.

Join us Next week!

January Coffee & Connect with Keynote Speaker Rex Fisher, co-owner of @properties IND, owner of RCA properties. Join us for coffee, bagels, and insightful conversation in the early morning! 7:30-9am January 15th, 2026. Find details here

Next Masterclass: Networking + panel discussion at Guggman Haus Brewing — our staple event and typically our largest and most accessible. March 19, 2026. Find details here

Our way of giving back to the neighborhoods we invest in. Being Rooted in Community means showing up — bags, gloves, and commitment. Add to Calendar. Next Sweep: March 27, 2026 at Broad Ripple Park.

Thanks for taking a look! Hope to hear from you soon. Please consider sharing with anyone you might think would be interested.

Do not hesitate to reach out at [email protected] or 831-206-9317, I would be excited to connect.

Have a great day!