Hey everyone, welcome back to RE: Indy for issue #003! I appreciate you being here and I am excited to share what is happening in the Indianapolis market. I hope everyone had a great Thanksgiving holiday.

Tyler sent out a deep market dive earlier this week that was packed with both local and national insight. I definitely recommend giving it a read. I pulled a few of my favorite takeaways and will be discussing them in this issue.

Please also consider signing up for our Roots Master Class this Thursday, 12/04, at Guggman Haus Brewery. It is shaping up to be a great event with a room full of Indianapolis real estate investors and plenty of good conversation. I hope to see you there!

Travel Note

My wife and I will be traveling to Japan & South Korea from 12/05 - 12/21 and visiting California for the Christmas holiday from 12/21 - 12/29. I will be working while away and will stay fully available for ongoing conversations and active transactions. If we are under contract during this window or have activate management needs, I will be connecting you with a team contact to have local support.

Expect some Japanese content in the next update 😃

I’m aiming to grow this email community to include both investors and traditional homebuyers. Please consider sharing with anyone you think would enjoy or benefit.

If this isn’t your thing, feel free to unsubscribe anytime — no hard feelings.

Deals Worth a Closer Look

3411 Brookside Pkwy S Drive Indianapolis, IN 46201

Duplex | 4 bed | 2 bath | 2188 sqft

$290,000

Why I Like It »»

Strong Rental Foundation: One side is already leased at 1,295, giving you day one income and flexibility on how to use the second unit.

Attractive Brookside Location: Directly across from Brookside Park, offering walkability, green space, and strong tenant appeal.

Solid 1920s Character: Brick exterior, covered porch, and practical layouts with peninsula kitchens and two bed two bath setups on each side.

Cash Flow Potential: With one side near market rent and the other ready to lease, you can build a solid rent roll quickly in a pocket that keeps gaining traction.

Investor Fit: Great for anyone wanting a stable, well located duplex with income growth potential and long term upside near a major city park.

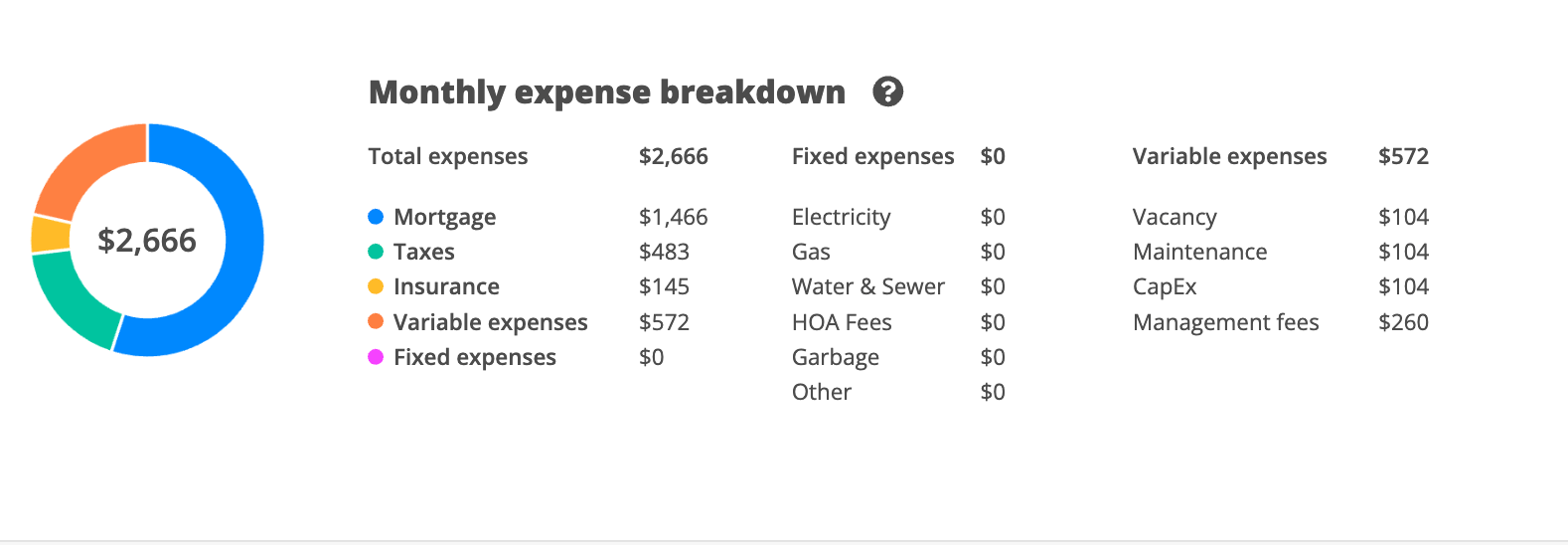

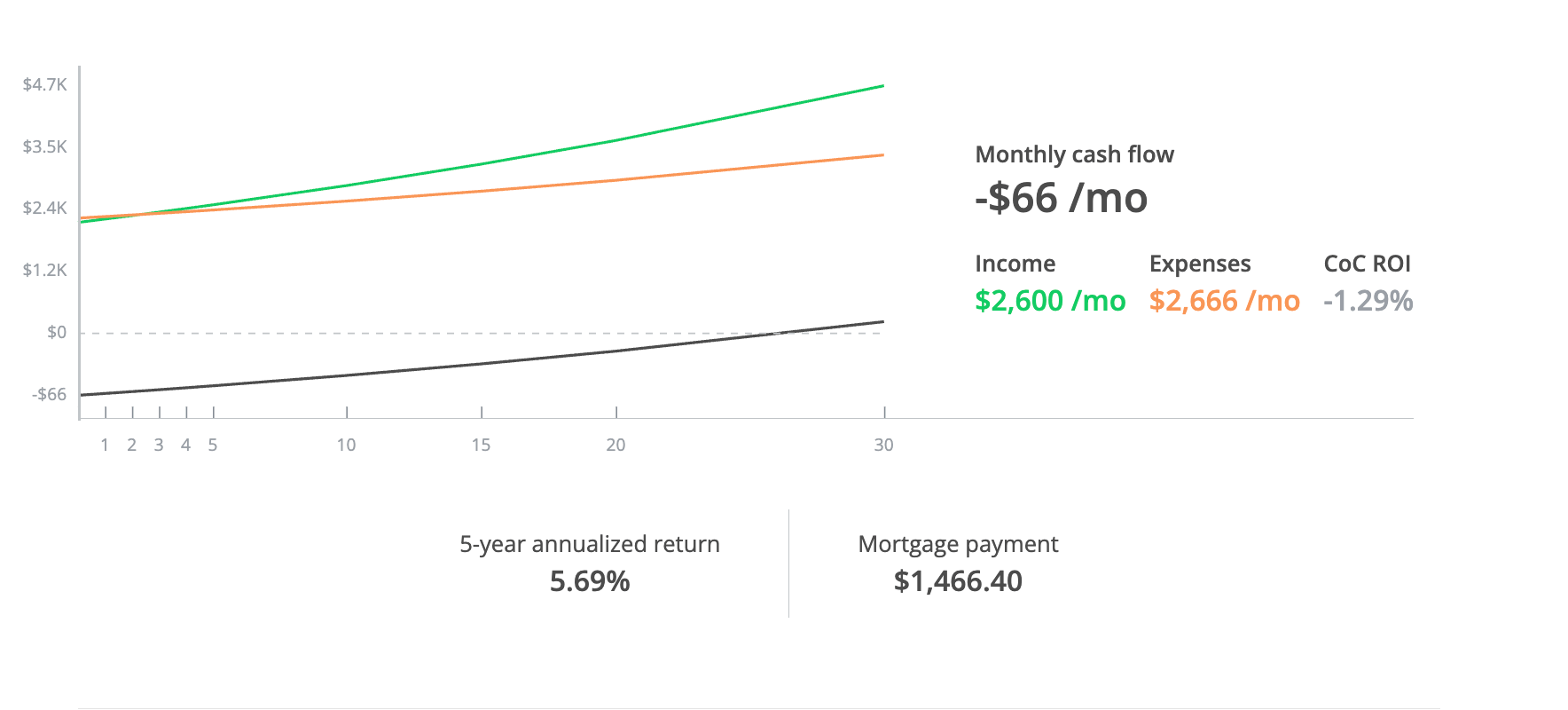

The Numbers »»

Purchase Price | Down Payment | GMR |

|---|---|---|

$290,000 | %20 » $58,000 | $2600 |

Vacancy | Maintenance | CapEx | Management |

|---|---|---|---|

4% | 4% | 4% | 10% |

The Play »»

Open in the Mid 270s: The pro forma at the full 290 price shows thin year one cash flow with a slightly negative monthly position once all expenses are counted. Opening at 270 to 275 reflects the current income and the work required to stabilize the vacant unit. Expect a counter and plan to meet somewhere between your offer and the list.

Stabilize Quickly: With one unit already at 1295 and the second unit open, you can reset the rent roll fast. This neighborhood can support steady rent growth over time. Your goal is to lock in strong tenants early to build toward long term performance.

Buy for the Long View: If you can buy it under ask, year one improves and the long view gets even stronger. Cash flow, equity, and loan paydown grow steadily over the next decade, with meaningful performance showing up early. It is a classic buy and hold in a rising pocket where a smart entry and a solid rent roll create real long term value.

2202 E 12th Street Indianapolis, IN 46201

Single Family | 3 bed | 1 bath | 2480 sqft

$218,500

Why I Like It »»

Location Power: This Craftsman bungalow sits in the sweet spot of Springdale / Windsor Park, a stable area on the rise — historic charm, mature surroundings, and mix of older homes and newer infill giving it long-term upside.

Attached Oversized Garage: The oversized attached garage adds a standout value driver. Garages typically add significant appeal and can even lift property value by $20,000–$35,000 compared to similar homes without one.

Neighborhood Momentum: The area is set for meaningful growth with the Factory Arts District underway and the major 10 Street renovation planned for 2026. These projects will bring new businesses, foot traffic, and long term energy to the corridor. Buying now lets you secure an asset ahead of that lift and benefit as the neighborhood improves and demand strengthens.

Best for a Local, Hands On Investor: This one makes the most sense for someone who can self manage. The current rent to cost profile does not produce strong cash flow today, so the play is neighborhood lift and long term value. You are locking in a sizable asset at a modest entry price with the expectation that appreciation, improving rents, and steady stabilization will pay off over time.

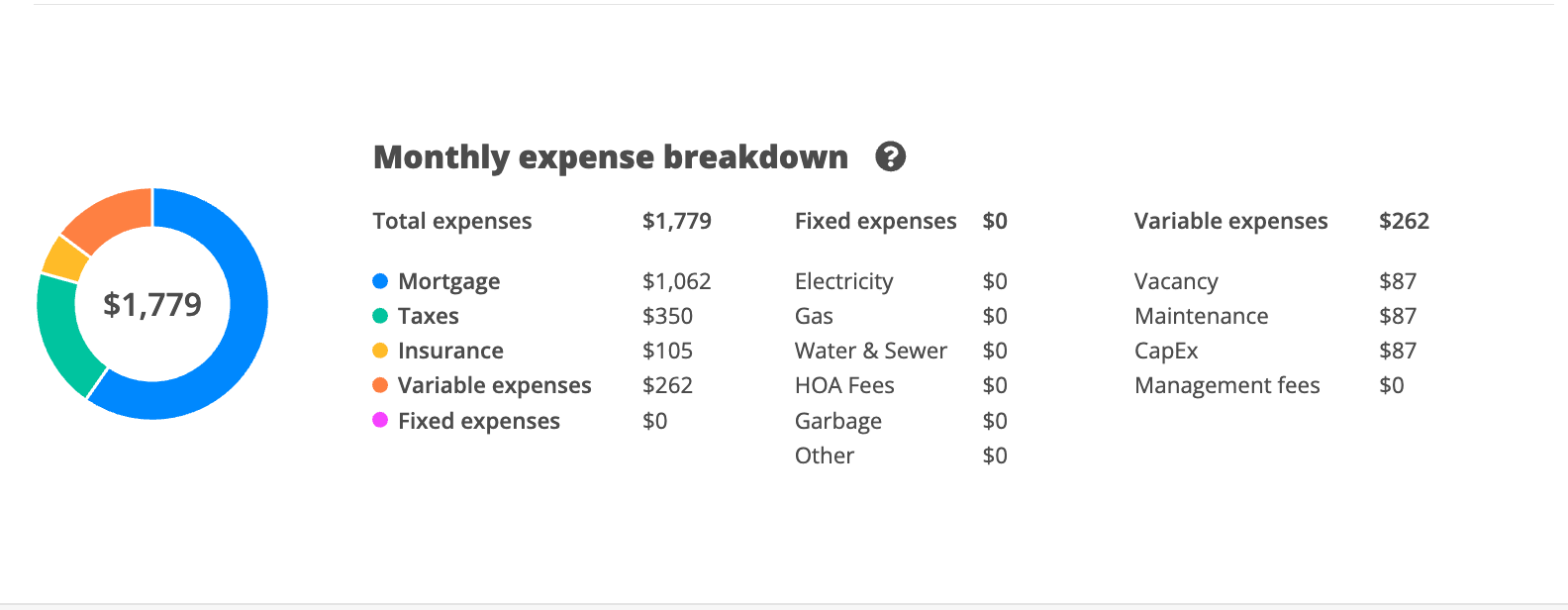

The Numbers »»

Purchase Price | Down Payment | GMR |

|---|---|---|

210,000 | %20 » $42,000 | $1750 |

Vacancy | Maintenance | Capex | Management |

|---|---|---|---|

5% | 5% | 5% | 0% |

The Play »»

Open sub 200: With accumulated days on market and a list at 218,500, open at 195. Expect a counter and plan to land in the low 200’s.

Negotiate Around Cash Flow Reality: Frame your offer around actual income and realistic rent growth timelines. Position your price as aligned with the work needed to stabilize returns over several years, not months.

Lean Into Long Term Appreciation: This is a neighborhood lift play. Lock in the asset now, manage it closely, and allow rising rents, continued reinvestment in Springdale and Windsor Park, and broader Near Eastside momentum to carry the value. Stabilizing with steady tenants, controlling maintenance, and keeping turnover low will be key to making the investment work long term.

3626 Birchwood Avenue Indianapolis, IN 46205

Duplex | 6 bed | 4 bath | 2460 sqft

$369,900

Why I Like It »»

Turnkey and Easy to Step Into: The duplex is clean, updated, and ready for immediate occupancy which makes it simple for an investor to place tenants and start collecting income without delay.

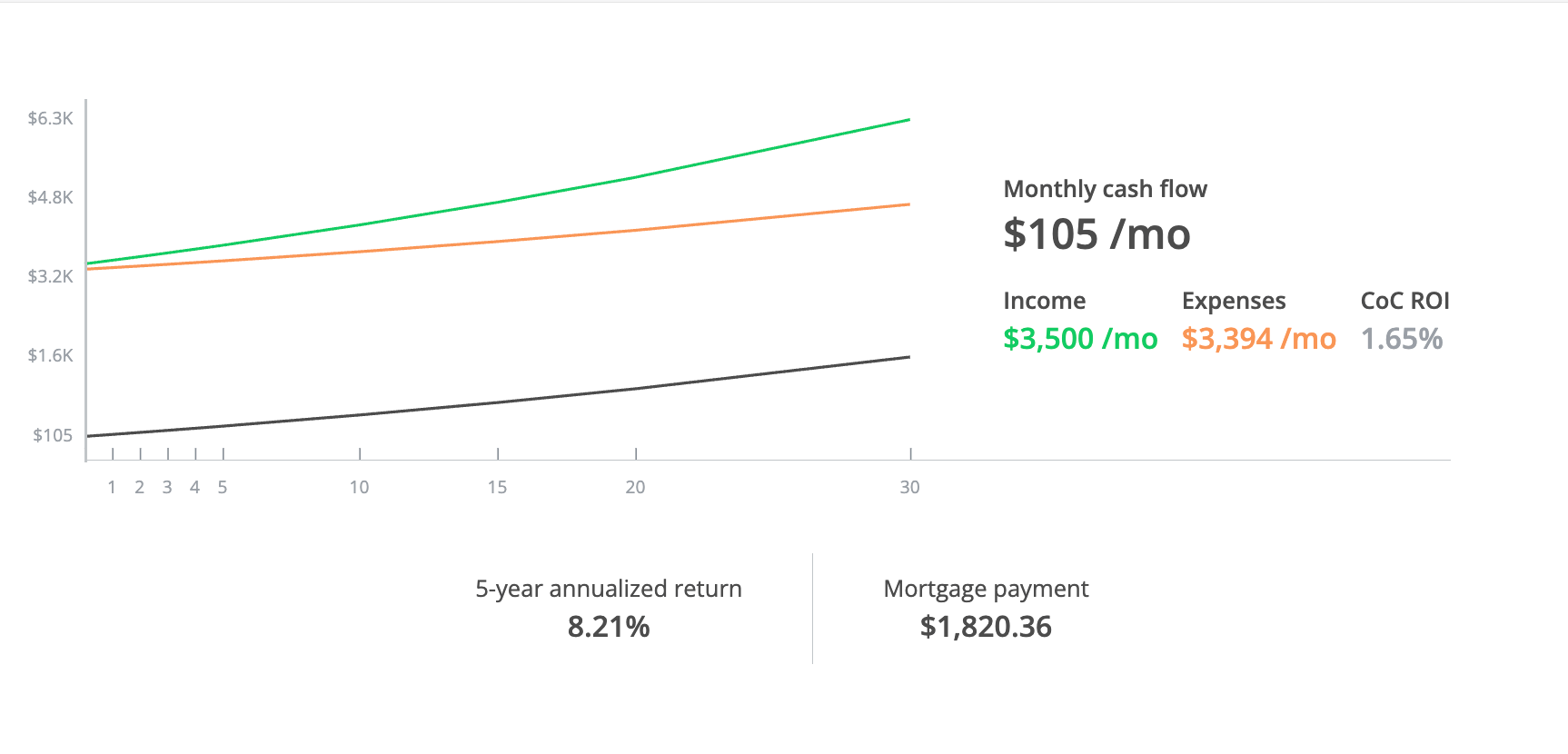

Positive Cash Flow at Market Rents: With fair market rent around 3,500 per month for both units, the property models as cash flow positive even at today’s rates when fully stabilized.

Neighborhood Pros & Cons: That cash flow stems from a central location with great access to downtown and the Monon trail, but this specific pocket of Mapleton-Fall Creek has nearby apartment buildings and is near the busy 38th St corridor, meaning the neighborhood lift may take time.

Investor Fit: Great for someone who wants a functional, income producing asset in an improving neighborhood with both stability today and appreciation potential.

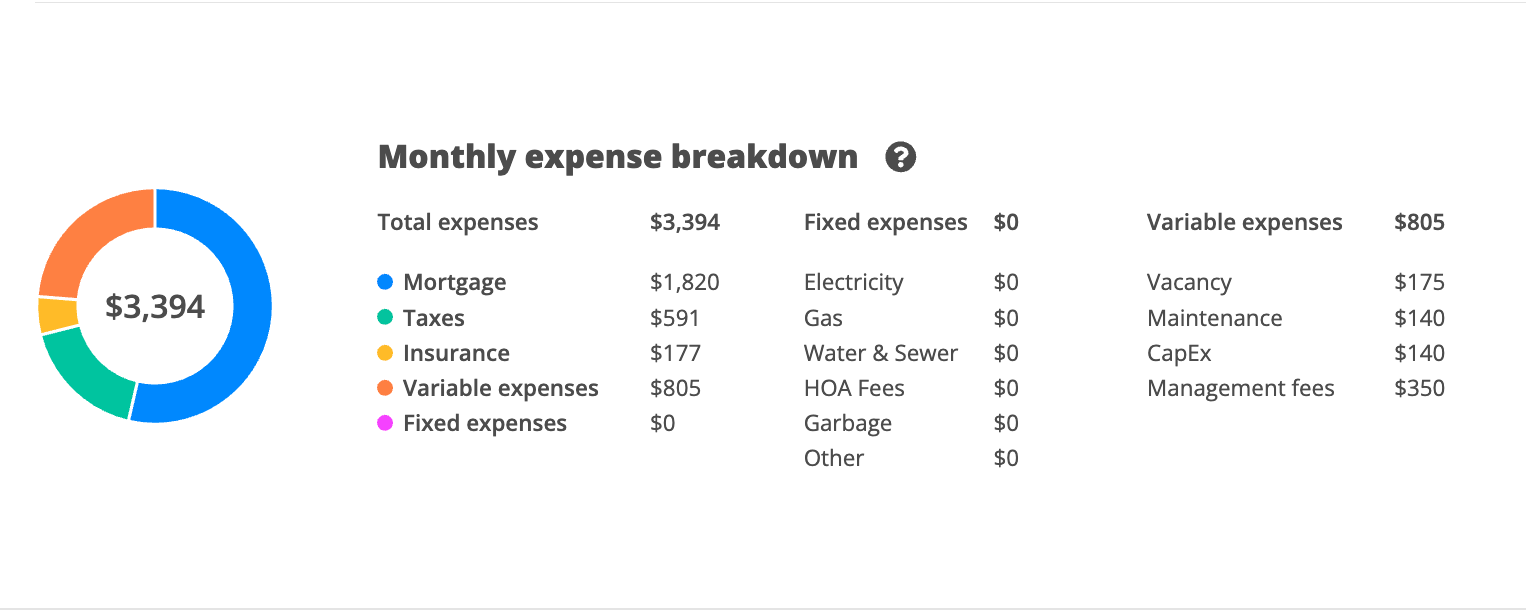

The Numbers »»

Purchase Price | Down Payment | GMR |

|---|---|---|

$360,000 | %20 » $72,000 | $3500 |

Vacancy | Maintenance | CapEx | Manangement |

|---|---|---|---|

5% | 4% | 4% | 10% |

The Play »»

Start at 345,000: The smart move is to underwrite the deal in the 350 to 360 range where the numbers still make sense, then come in near 345 to start the conversation and work toward a solid entry price.

Underwrite for Immediate Stabilization: The goal here is not a heavy value add but a fast, clean stabilization. Confirm the units are rent ready, bring both sides to fair market rent quickly, and lock in a consistent rent roll. Solid tenants in this corridor can dramatically improve long term performance and reduce turnover risk.

Hold for Appreciation and Efficiency: Mapleton Fall Creek continues to strengthen as the Monon Trail corridor develops and the near north neighborhoods densify. This is a hold that improves every year through rent growth, modest appreciation, and loan paydown. Keep expenses tight, manage proactively, and let the location do the heavy lifting over time.

5680 N Delaware Street Indianapolis, IN 46220

Single Family | 3 bed | 2.5 bath | 2639 sqft

$535,000

Bonus »»

This one really caught my eye because it blends charm, location, and private comfort into a package that’s increasingly rare in Indianapolis. 5680 N Delaware sits in the heart of Meridian‑Kessler and offers 2,639 square feet with 3 bedrooms and 2.5 baths — enough room to live big without feeling oversized. The home balances classic touches like brick, clean lines, and a welcoming front patio with modern updates inside. The backyard and overall layout make it a quiet retreat in a lively, desirable neighborhood.

It’s a standout listing: a move-up home that gives you the best of old-school charm and current comforts.

Market Snapshot

As I mentioned at the top, Tylers’s full market breakdown has ton of great information. These 3 graphs really stood out for me.

Indiana’s housing supply is up eighteen percent year over year. Demand was strong early in the year, but rising inventory after mid June has shifted the balance.

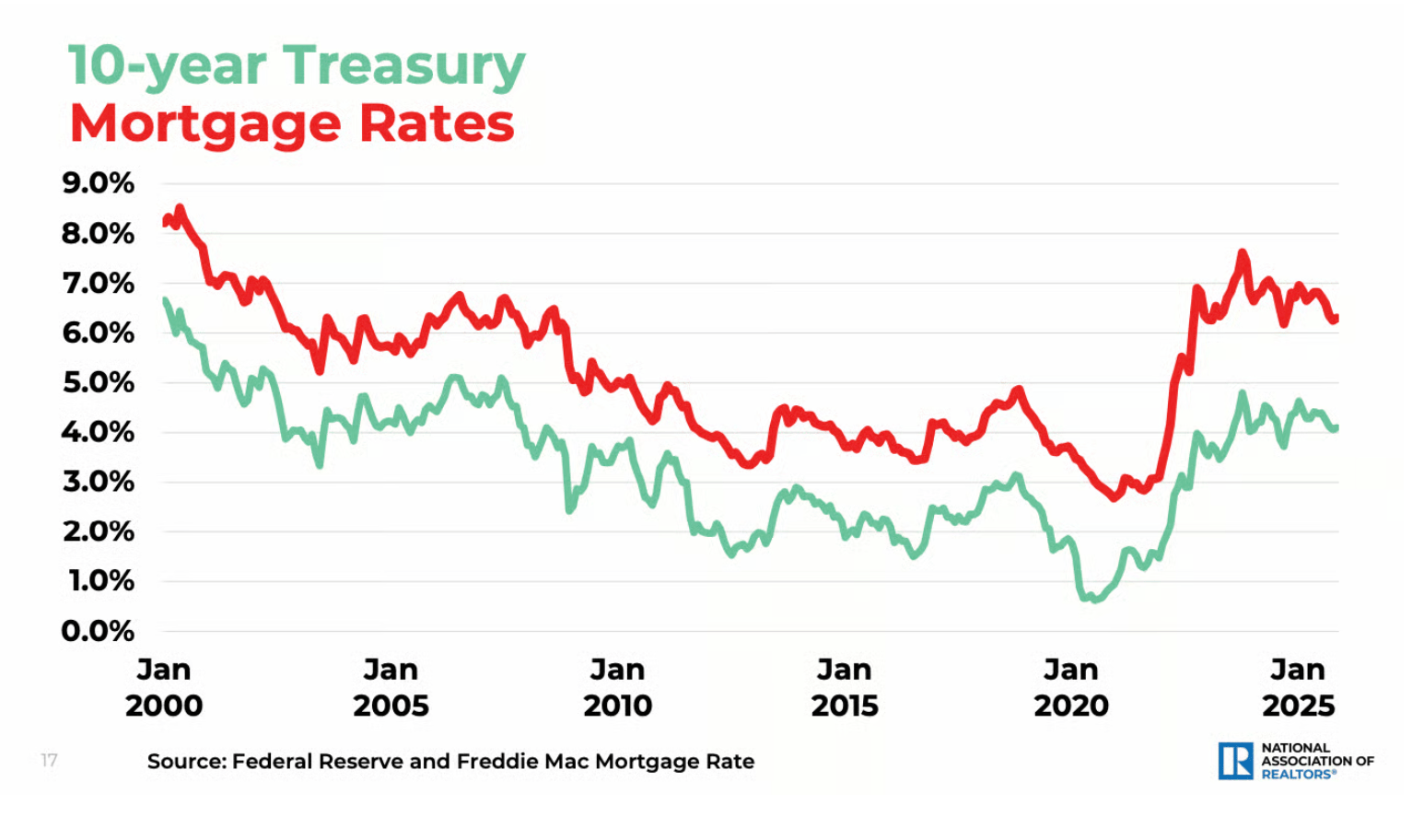

We have been in the low 6’s for a while now. A tick into the mid 5’s next year could bring more investor activity and competition.

NAR is forecasting that rate decrease remains in place, and we see an increase is sales and value gains compared to 2025.

Thanks for taking a look! Hope to hear from you soon. Please consider sharing with anyone you might think would be interested.

Do not hesitate to reach out at [email protected] or 831-206-9317, I would be excited to connect.

Have a great day!