Hey Beautiful People - Welcome Back

Thanks to everyone who shared the first issue or reached out - great to reconnect with so many of you. And to all the new subscribers, welcome. RE: Indy is a deep dive into the Indianapolis real estate market, built to make investing feel clearer, more accessible, and more actionable.

My goal is simple: break down real properties, real numbers, and real strategies so you can move with confidence. Real estate is one of the strongest long-term wealth-building vehicles out there, and Indianapolis remains one of the most compelling growth markets in the country.

Please consider sharing with anyone you think would be interested!

The real estate world never runs out of headlines, and the past few weeks have offered plenty to watch. The conversation around a possible fifty year mortgage has picked up. Max and Tyler give a good breakdown of what that could mean for investors.

Nationally the market appears to be plateauing. It is hard to know what comes next, and while past slowdowns have often set the stage for the next leg up, consumers buying power feels more stretched than in previous cycles, making even entry level inventory feel unattainable.

If all else fails, maybe the future is oversized home additions like the one making the rounds this week. Who wouldn’t want to live in the shadow of that project?

At any rate, let’s dive into the deals.

1318 N Grant Ave, Indianapolis, IN 46201

Single Family | 2 bed | 1 bath | 1255 sqft

$199,000

Why I Like It »»

Turnkey Simplicity: Updated, clean, and immediately rentable. No upfront renovation needed, making it simple to step into as a new acquisition.

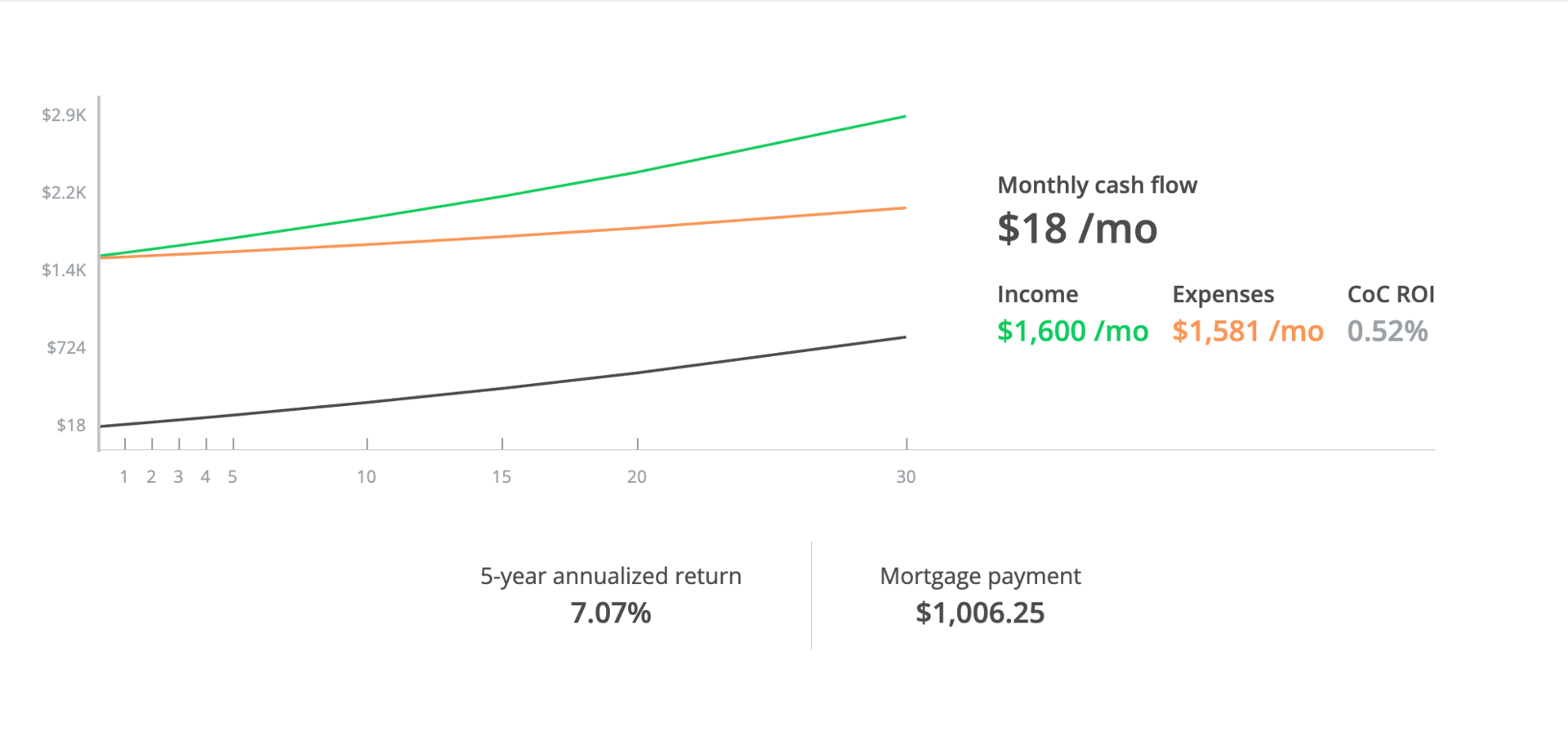

Solid Rental Range: Long-term rents in this condition in this pocket comfortably support $1,500–$1,650/month, Modeled below at $1600/month.

Neighborhood Momentum: Located in Little Flower on the Near Eastside — a steadily improving C+ to B- area with ongoing investment, strong community appeal, and growing interest from both owner-occupants and investors.

Flexible Strategy: Works as a standard long-term rental, but also checks the boxes for a mid-term rental play thanks to proximity to hospitals, downtown, and quick interstate access.

Investor Fit: Ideal for someone seeking an easy, low-friction hold with decent numbers today and improving upside as the neighborhood continues to strengthen.

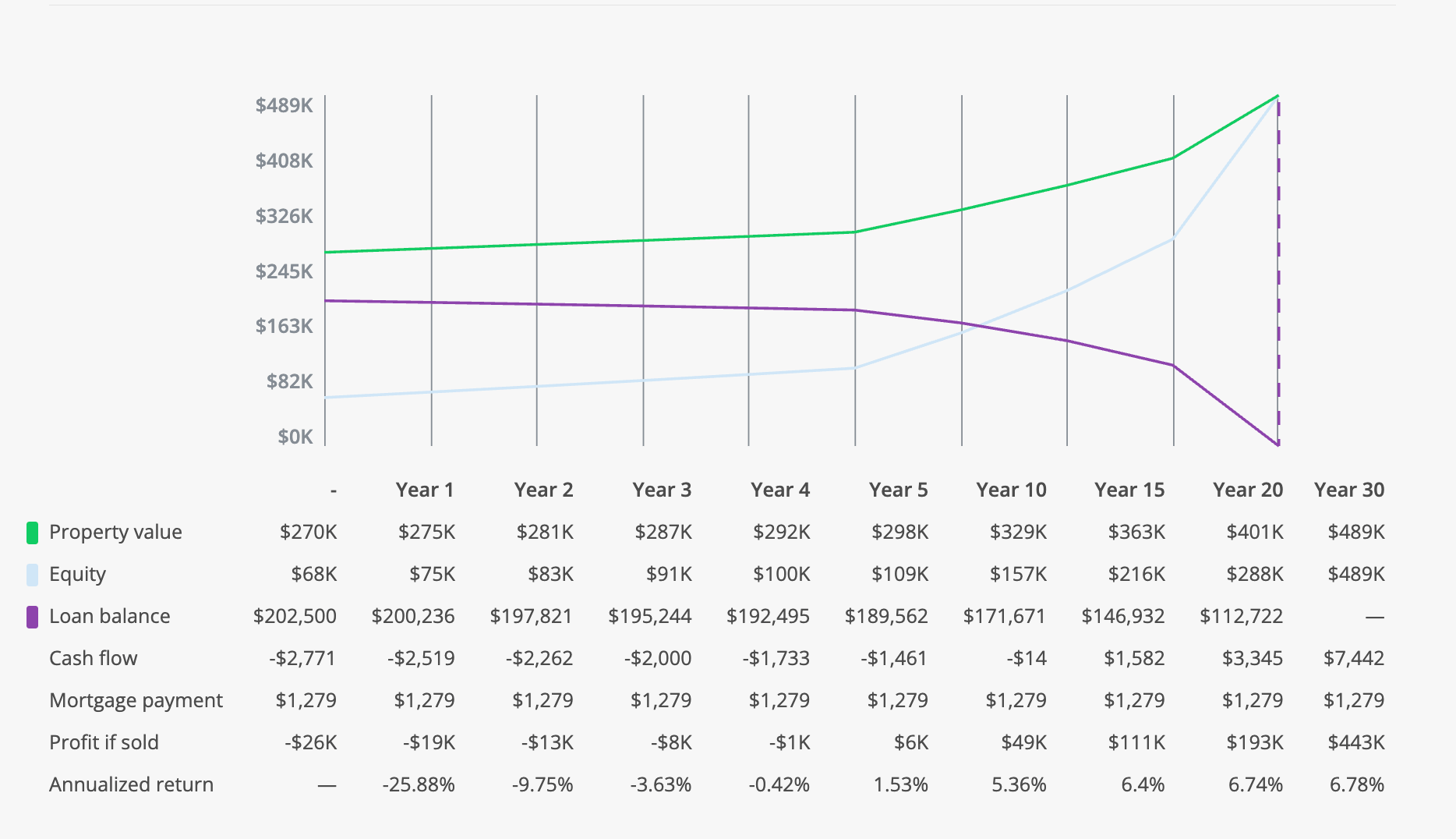

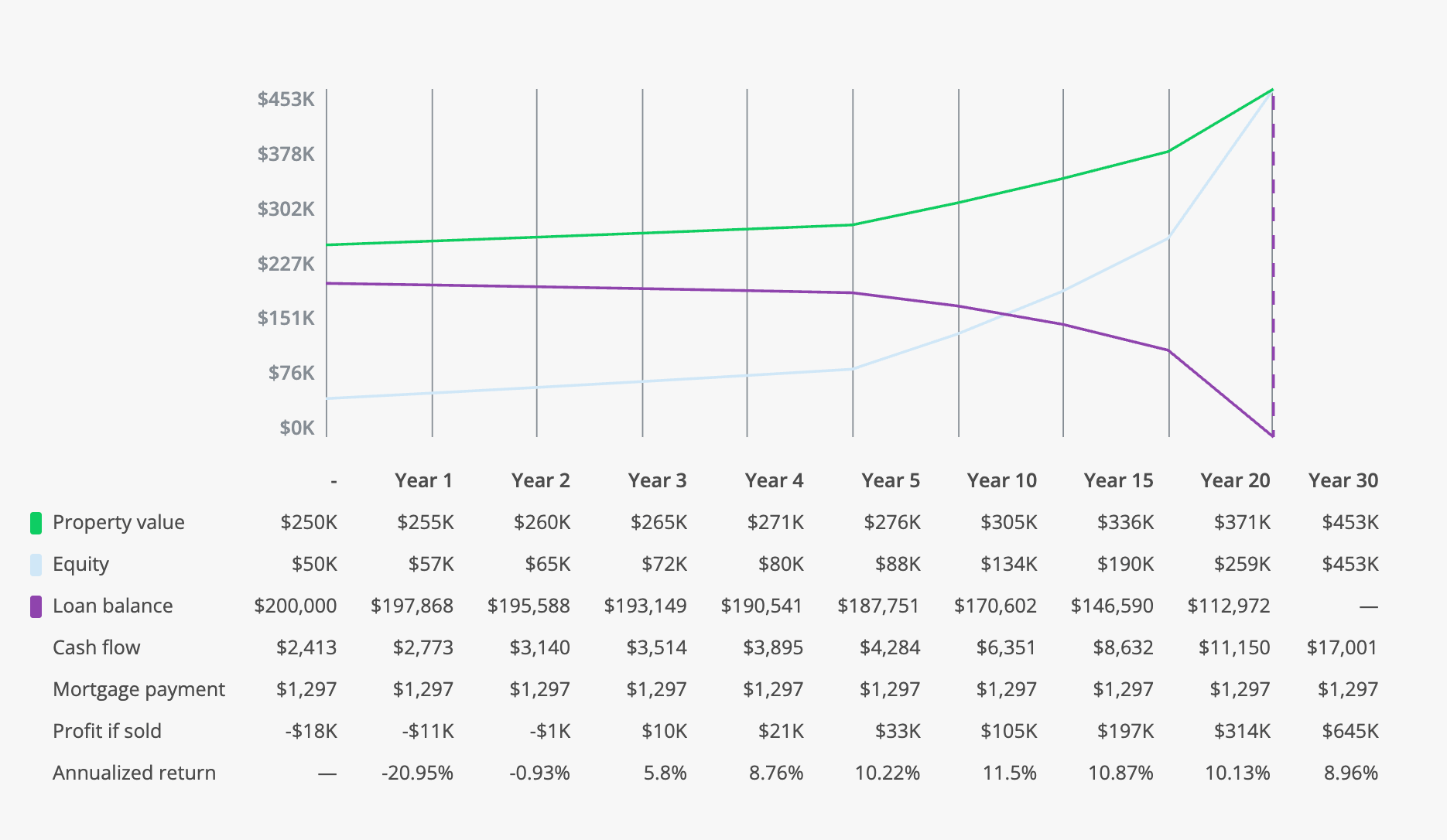

The Numbers »»

The Play »»

Aim for the Low 180s: Start your offer in the $175–185K range. It reflects current rents, acknowledges neighborhood comps, and gives you room to win without overpaying.

Leverage Turnkey Readiness: Because the home is clean and move-in ready, position your offer as certainty and speed — quick inspection, quick close, minimal demands. Sellers love low-friction buyers.

Underwrite Both Scenarios: Run numbers for both long-term rent and a mid-term model. This gives you optionality depending on what the market does, and Little Flower supports either strategy.

Focus on Cash Flow + Upside: This isn’t a pure cash-flow play; it’s the balance of immediate stability with slow, steady appreciation as the area continues to improve. Hold for 3–7 years to capture the neighborhood’s lift.

Keep the Inspection Tight: Focus on roof, foundation, mechanicals. If anything surprises you, ask for a small credit, but don’t nickel-and-dime. Your leverage is speed and clean terms.

Investor Fit: Best suited for someone who wants an easy, low maintenance entry into the Near Eastside and is comfortable self managing.

269-271 E Burgess Avenue Indianapolis, IN 46219

Duplex | 6 bed | 3 bath | 2800 sqft

$270,000

Why I Like It »»

Long-Term Upside: A large, character rich duplex in Historic Irvington, a neighborhood with steady demand and a deep rental base where well maintained multi family properties are consistently sought after.

Under-rented Opportunity: Current long-term tenants pay $950 per side, well below market. FMR is closer to $1300 - $1500 per side. While leases run through October 2026, this creates a clear value-add pathway once turnovers occur.

Strong Bones & Scale: Separate fenced yards, dedicated driveways for each unit, a 10,000 sqft lot, and spacious layouts.

Potential for Equity Play: Some mechanical updates are in place, but the property will need improvements at turnover. With the right purchase price negotiation, the current cash flow gap can be offset, setting up meaningful upside as the market strengthens.

Investor Fit: Ideal for an investor seeking a long-term hold with significant appreciation and rent-growth potential rather than immediate cash flow.

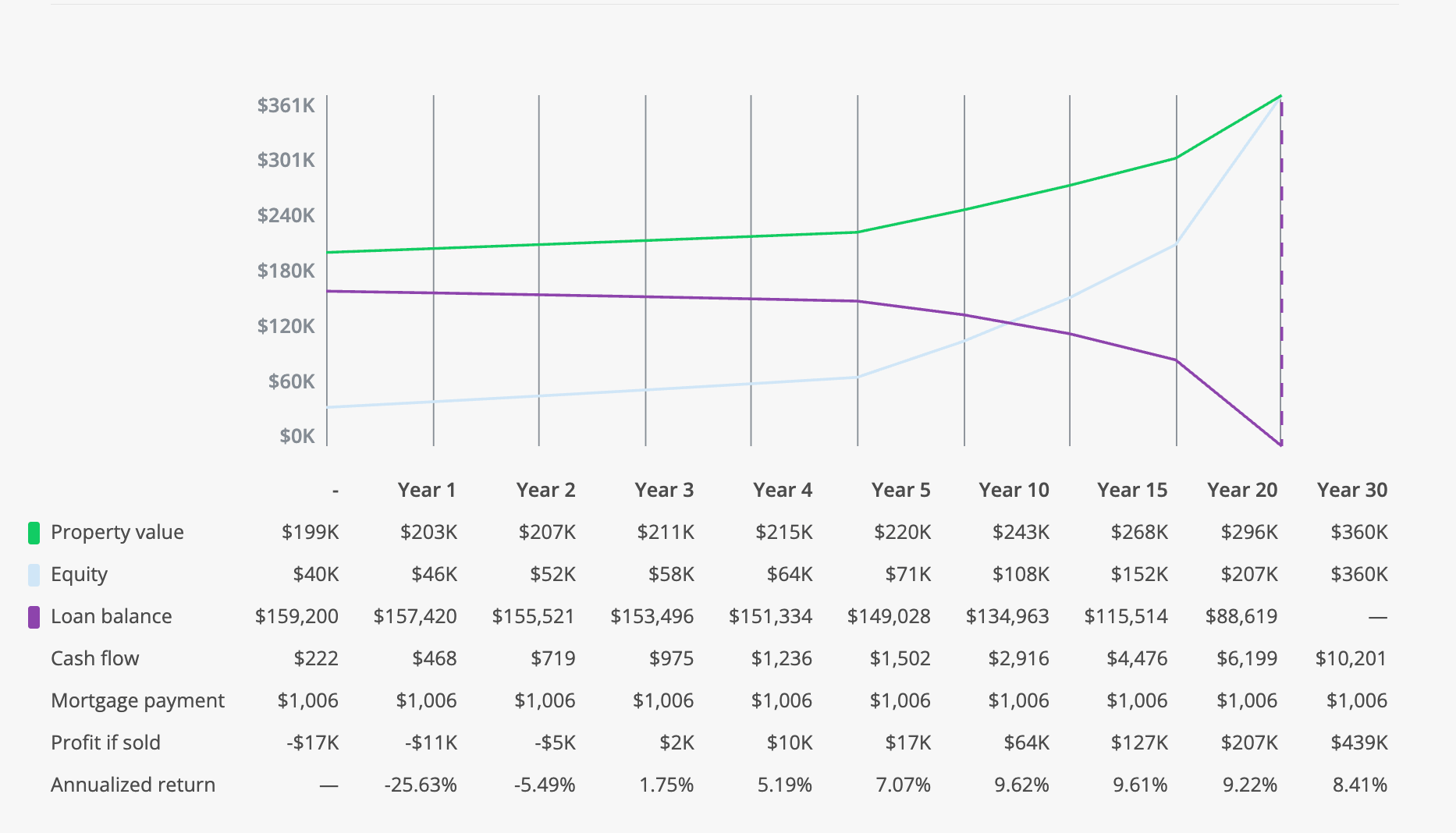

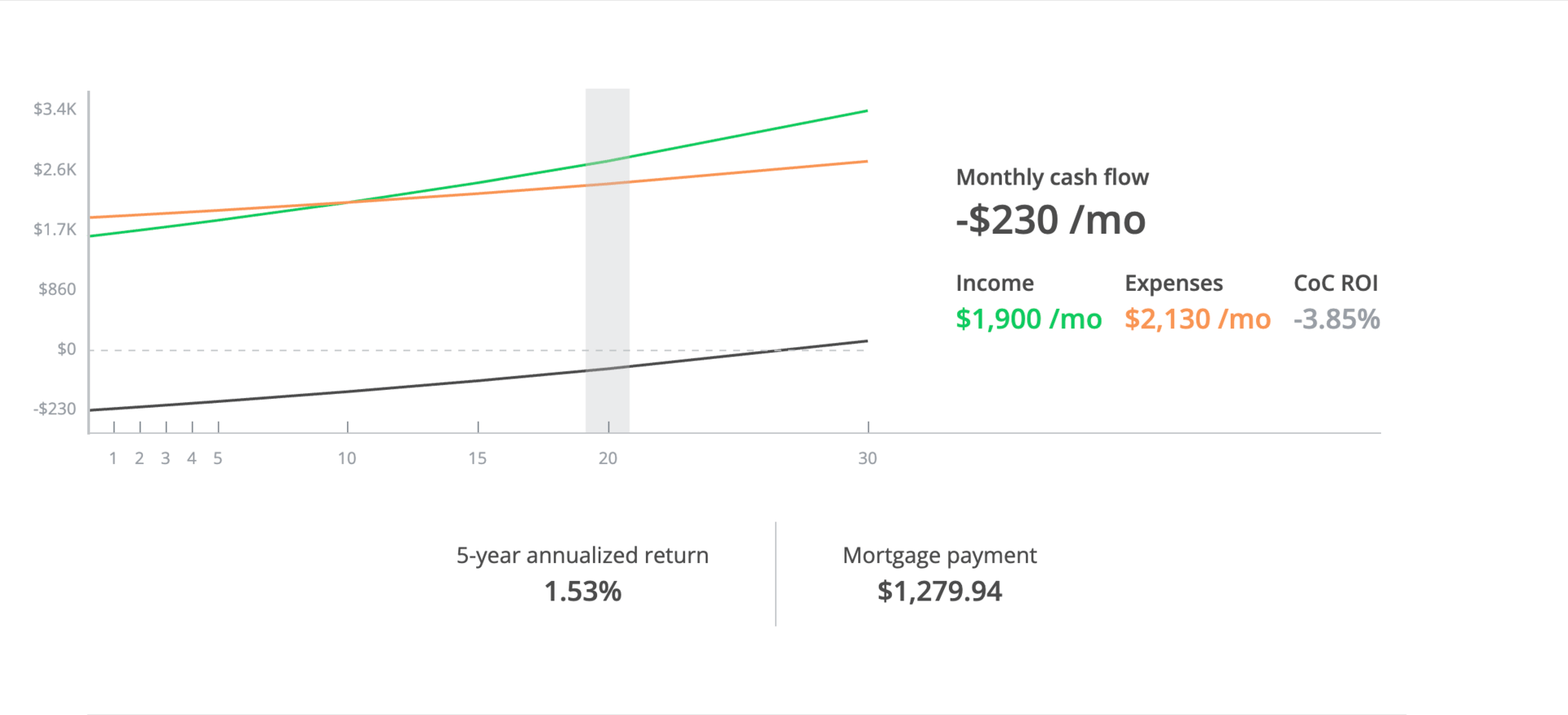

The Numbers »»

The Play »»

Start at $235K: With below-market rents and leases locked through October 2026, the property will run negative until turnover without a significant downpayment. Push to capture that shortfall in the purchase price rather than absorbing it over two years. Expect to meet in the middle, but there enough unknowns here to justify a soft initial approach.

Secure Inspection Credits: Roof age (20 years) and long-term wear-and-tear are valid leverage points. Aim for a meaningful credit during the inspection period to offset near-term capital needs.

Hold for the Spring Market Shift: If activity and pricing strengthen next year, you will already be in position with a substantial Irvington duplex before competition increases.

4449 N College Ave, Indianapolis, IN 46205

Duplex | 2 bed | 2 bath | 1628 sqft

$310,000

Why I Like It »»

Prime Location: Sitting in Meridian-Kessler, one of Indy’s most desirable core neighborhoods, with fast access to downtown, Broad Ripple, and everything along the College Ave corridor.

Walkability Advantage: Steps from great local spots. Restaurants, cafés, and the Guggenheim Brewery on 46th.

Solid Construction: All brick build with an integrated lower garage offers durability and lower long term exterior maintenance.

Clean, Functional Layout: Well-maintained spaces that are easy to live in and easy to rent, without the immediate need for renovation or heavy lifting.

Immediate Income: One side is already leased at 1250/month which provides day one stability and reduces your initial vacancy risk.

Investor Fit: Ideal for someone who wants a low-maintenance asset in a premium neighborhood, a classic location-first investment.

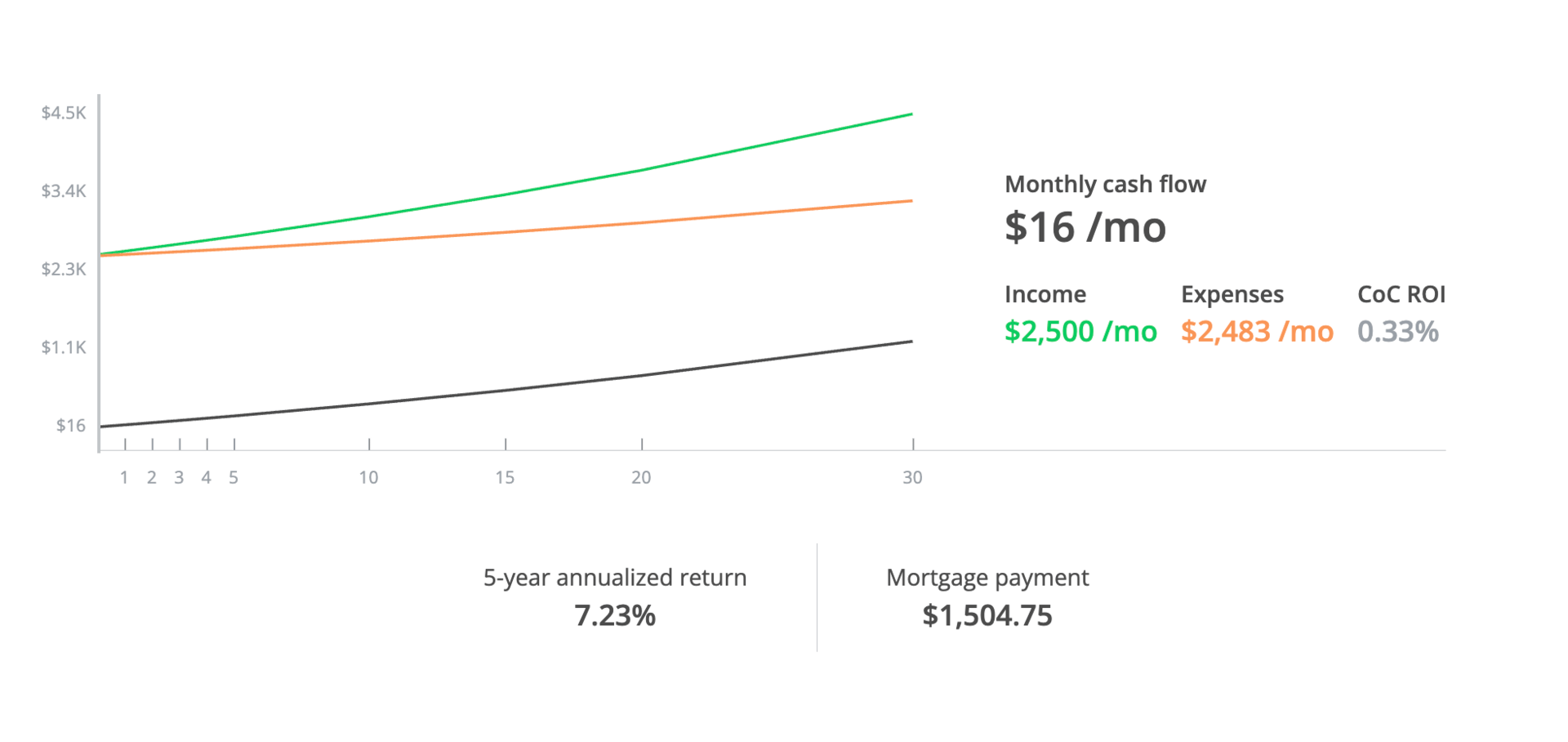

The Numbers »»

The Play »»

Target a Smart Entry: Open at 270k to anchor the negotiation. Expect a counter and plan to land near the middle around 280k to 285k. “The Numbers” is modeled at a 290k purchase and keeps the deal inside a safe range for long term performance.

Use Days on Market to Your Advantage: The property is nearing two months on market which creates leverage. Offer clean terms, quick inspection, and the ability to close without friction. That combination often wins in Meridian Kessler when sellers prioritize certainty over squeezing every dollar.

Protect the Asset on Inspection: Focus on roof age, window condition, and any moisture concerns around the lower garage level. These are the items most likely to justify credits. Securing even modest concessions strengthens your long term investment profile without derailing the deal.

3942 Cornelius Ave, Indianapolis, IN 46208

Duplex | 6 bed | 3 bath | 2276 sqft

$249,900

Why I Like it »»

Path to a True One Percent Duplex: With one side already rented at 1200 and the vacant side positioned to lease higher, this property has a realistic path to hitting the one percent rule once stabilized.

Reliable Butler Tarkington Demand: The location sits in a steady, rental friendly pocket near Butler University and just south of Meridian Kessler which brings long term stability, consistent tenant pools, and real upside over time.

Rental Grade Today: The duplex is rent ready with minimal immediate repair needs. It is older which means reinvestment will be needed at turnover, but nothing that blocks day one income.

Varied and Functional Layouts: Two different floor plans add leasing flexibility. The larger unit offers a more open main level which tends to rent faster and attract longer term tenants.

Two Car Garage Advantage: A shared garage is a rare bonus in this submarket and adds value for tenants, improves retention, and strengthens the overall rental profile.

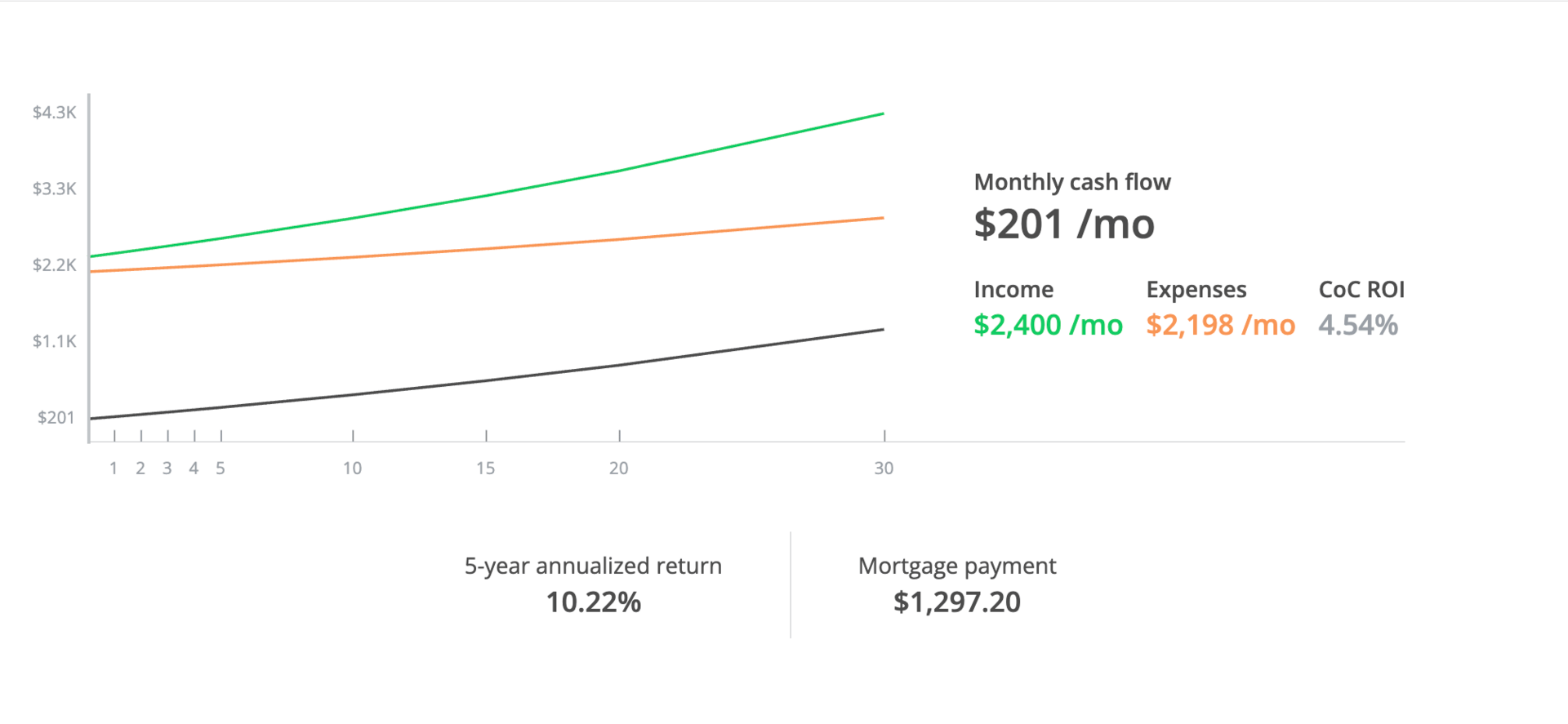

The Numbers »»

The Play »»

Start at 235: With thirty days on market, a list at 250, and one side still vacant, a mid 230s offer is a fair anchor. Don’t expect a deep discount from list, this is priced with investors in mind, but with time passing open at a place that brings a counter.

Buy for Stabilization: The one percent rule becomes realistic once both sides reach market rent. Negotiate based on current income, not future upside, and keep terms clean to strengthen your position.

Use the Vacancy: The empty unit allows you to set new market rent immediately. Highlight this in negotiation since you are absorbing the leasing work and turnover risk.

214 E Saint Joseph St, Indianapolis, IN 46202

Single Family | 5 bed | 6 bath | 5760 sqft

$1,250,000

Bonus »»

It is always exciting to see a home that shows what is possible with Indianapolis architecture. This one blends its 1880 roots with updated design that feels intentional and refined. You still get the historic character, but now it comes with modern convenience and a few unexpected touches like a secret door, a wine cellar, and a bright pool area ready for summer. It stands out in the heart of downtown as a unique property with plenty of life ahead of it.

ROOTS NEWS

Street Sweep Success: We had an amazing Street Sweep number #2. Our team and others in the investment community came together to clean up Riverside Park and keep building momentum in the neighborhood. If you want to join the next one, consider signing up for our March 27th walk of Broad Ripple Park.

Upcoming MasterClass: We are hosting a Roots MasterClass on December 4th at Guggman Haus Brewing from 6-8PM. It is a great chance to connect with our team and others in the investing community.

We would love to see you there. BOOK YOUR TICKETS

I’m aiming to grow this email community to include both investors and traditional homebuyers. Please consider sharing with anyone you think would enjoy or benefit.

If this isn’t your thing, feel free to unsubscribe anytime — no hard feelings.

Do not hesitate to reach out at [email protected] or 831-206-9317, I would be excited to connect.

Have a great day!