Hi, I’m Ken Fletcher, an Indianapolis REALTOR® and a member of the Roots Realty Team. Welcome to the first issue of this newsletter!

RE: Indy is a data-driven look at the Indianapolis real estate market — what’s moving, what’s sitting, and where the real opportunities lie. While this newsletter is built with investors in mind, anyone buying, selling, or simply curious about the Indianapolis market will find valuable insights here.

If you’re receiving this it’s because you signed up or connected with me about Indy real estate, or you’re a friend or colleague I haven’t reached out to in a bit. If your on this list for Issue #001, please know your the inner circle and I appreciate you, I would love to chat on a call sometime soon, either to talk real estate or just reconnect.

What to expect from RE: Indy »»

Deals you can buy today, and why you should

Indy Market Data and what it means

Neighborhood spotlights

Personal updates

I’m aiming to grow this email community to include both investors and traditional homebuyers. Please consider sharing with anyone you think would enjoy or benefit.

If this isn’t your thing, feel free to unsubscribe anytime — no hard feelings.

4 Deals Worth a Closer Look

37-39 N Catherwood Ave, Indianapolis, IN 46219

Duplex | 4 bed | 2 bath | 1500 sqft

$170,000

Why I Like it »»

Turnkey Income: Two well-maintained 2BD/1BA units, both leased through spring 2026 providing reliable cash flow from day one.

Solid Returns: Gross income of $1,795/month ($21,540 annually) against a $170K list price. a strong rent-to-price ratio in a stable Eastside submarket.

Low Maintenance: Brick exterior, simple mechanicals, and long-term tenants reduce turnover and Capex risk. Perfect for passive or out-of-state owners.

Investor Angle: A pure income property with in-place leases and clean condition. Perfect for Investors willing to self manage.

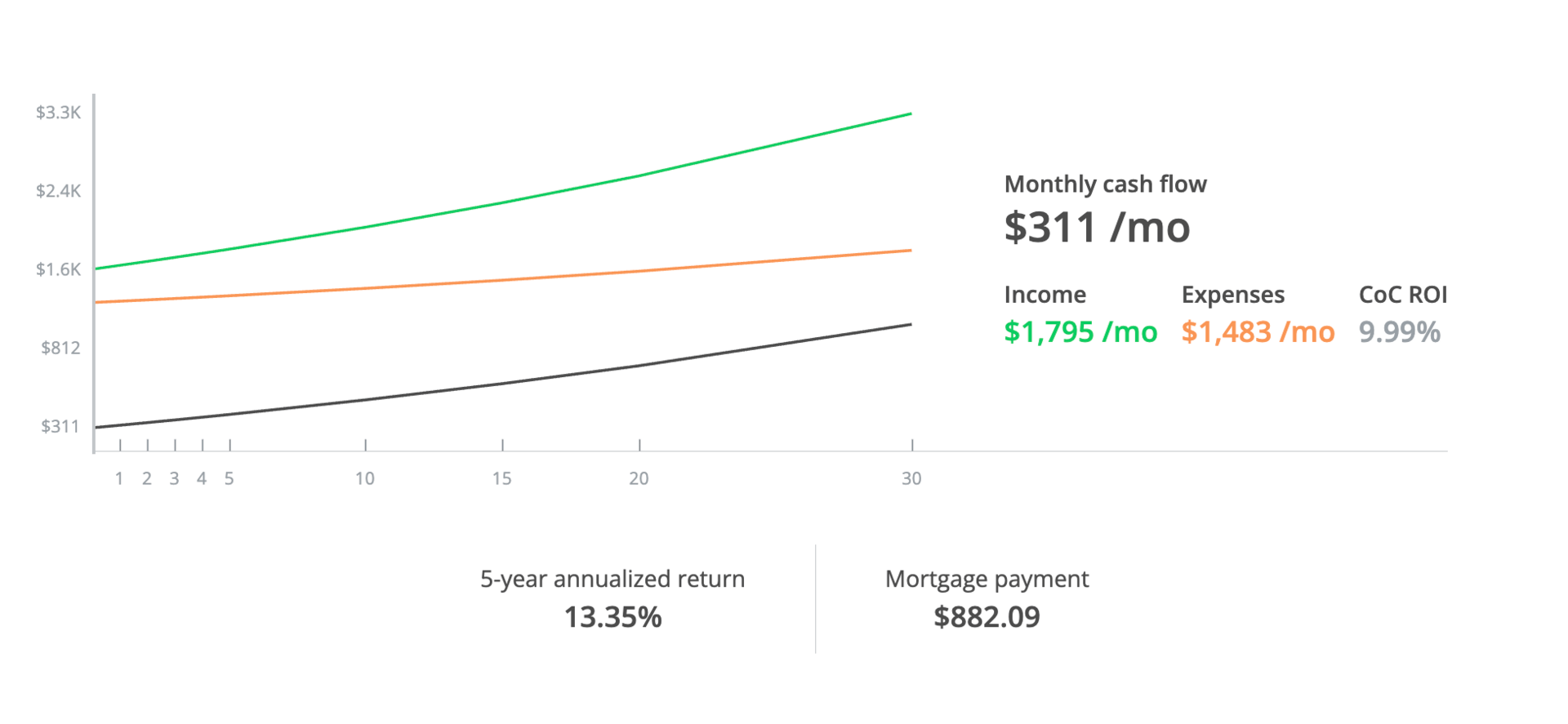

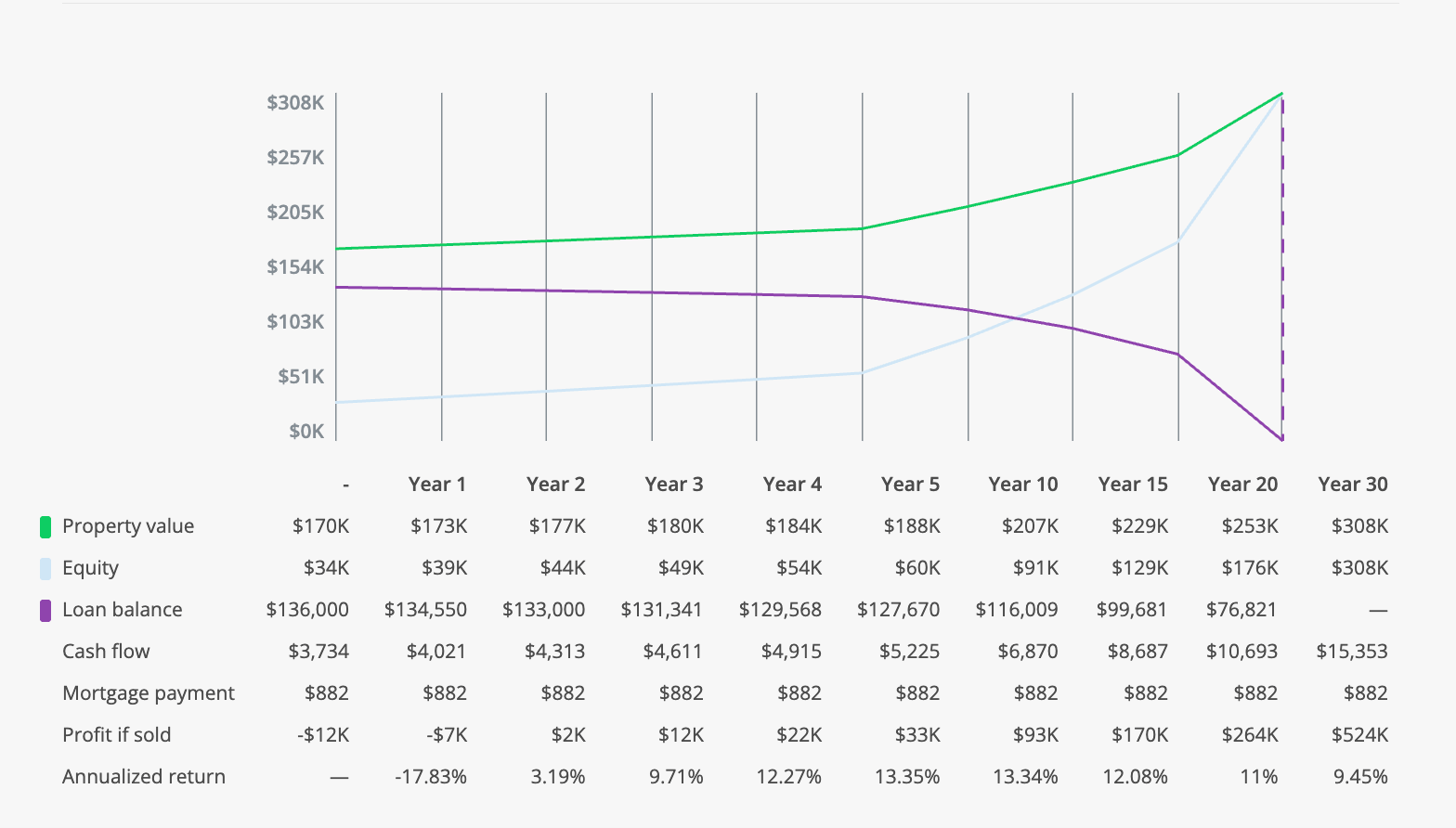

The Numbers »»

1414 Ingomar St, Indianapolis, IN 46241

Single Family | 3 bed | 2 bath | 1084 sqft

$155,000

Why I Like it »»

Turnkey Condition: Updated 3 bed, 1.5 bath home with clean finishes and newer mechanicals, ready for move-in or immediate rental.

Strong Rent History: Previously leased for $1,500 per month, offering a solid rent-to-price ratio around the 1 percent mark.

Location Advantage: Close to the airport and major routes, an area with consistent renter demand and stable employment.

Investor Edge: Minimal maintenance and reliable returns, ideal for investors seeking steady performance and limited upkeep.

Full Disclosure: I am the listing agent on this property.

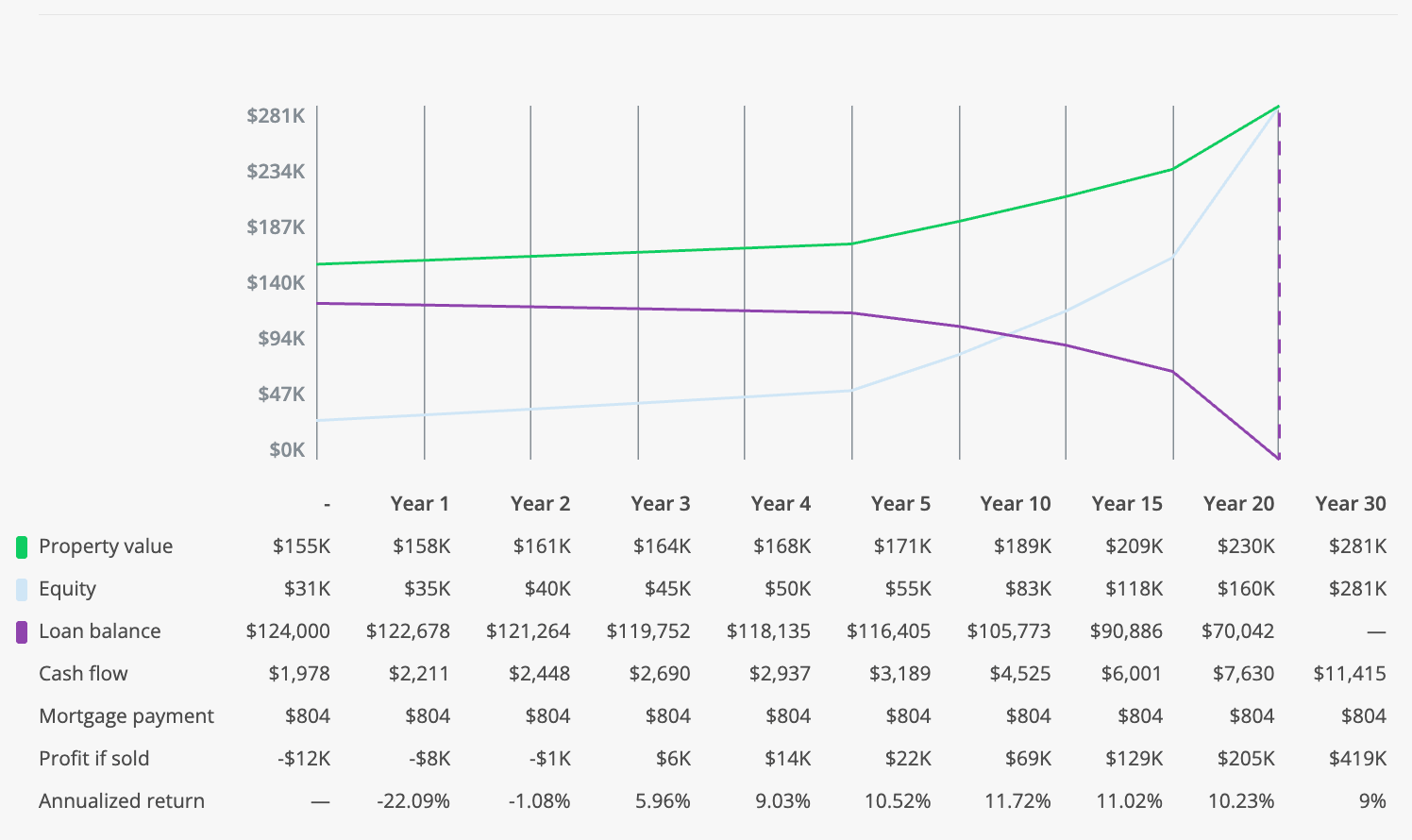

The Numbers »»

1843 Kildare Ave, Indianapolis, IN 46218-4642

Single Family | 3 bed | 2 bath | 984 sqft

$189,900

Why I Like it »»

Turnkey Condition: 3 bed & 2 Full baths, fully updated with new flooring, paint, HVAC, windows, and a modern kitchen.

Value Entry: Listed under $200K in a solid near-east-side location (Irvington/Brookside corridor) strong potential for upside.

Mid-Term Potential: Located near several major hospitals ideal for traveling nurses or professionals seeking 3- to 6-month stays.

LTR vs MTR: Has the safety of near break even cash flow as a long term rental, with significant upside potential as a mid term. Expected $2,000+ a month.

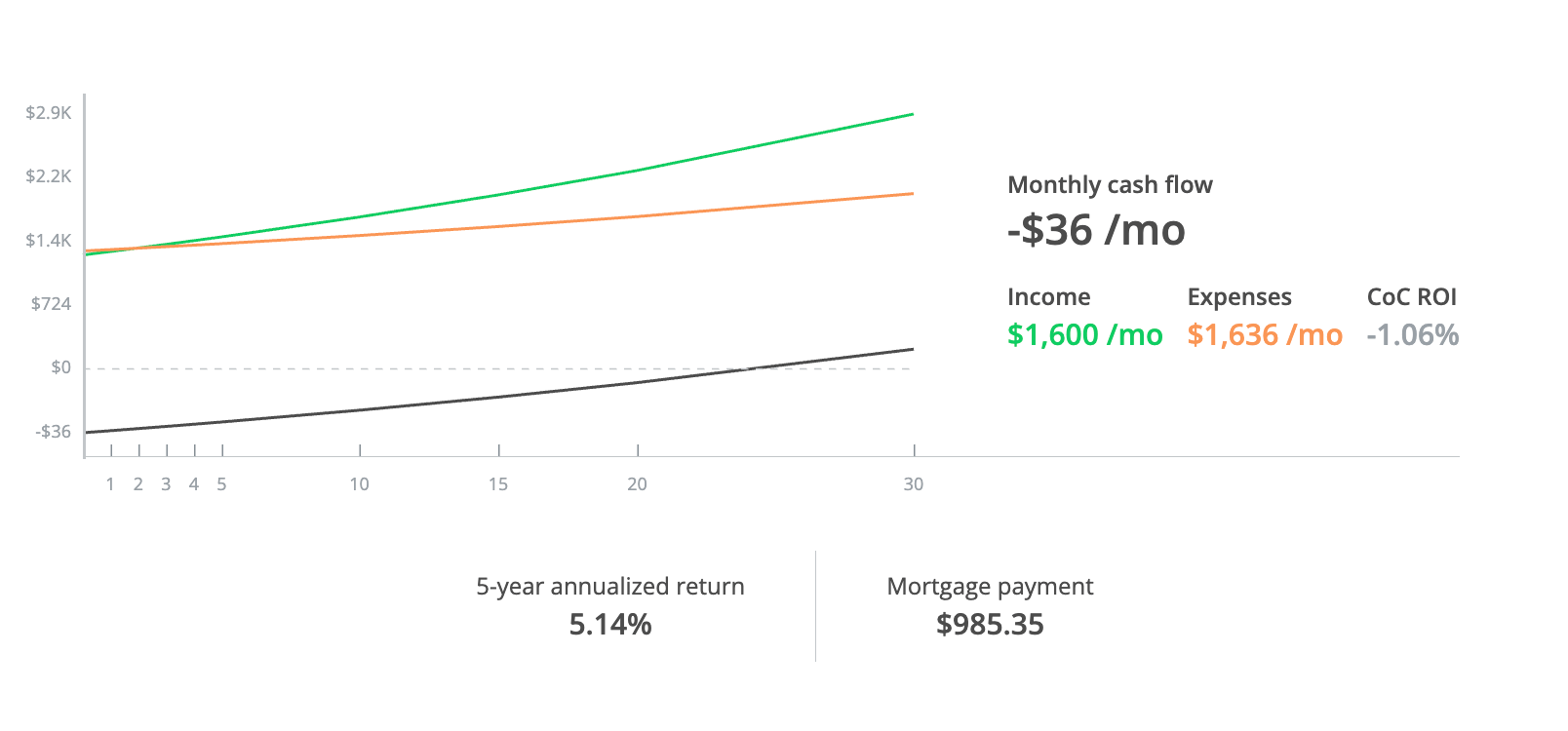

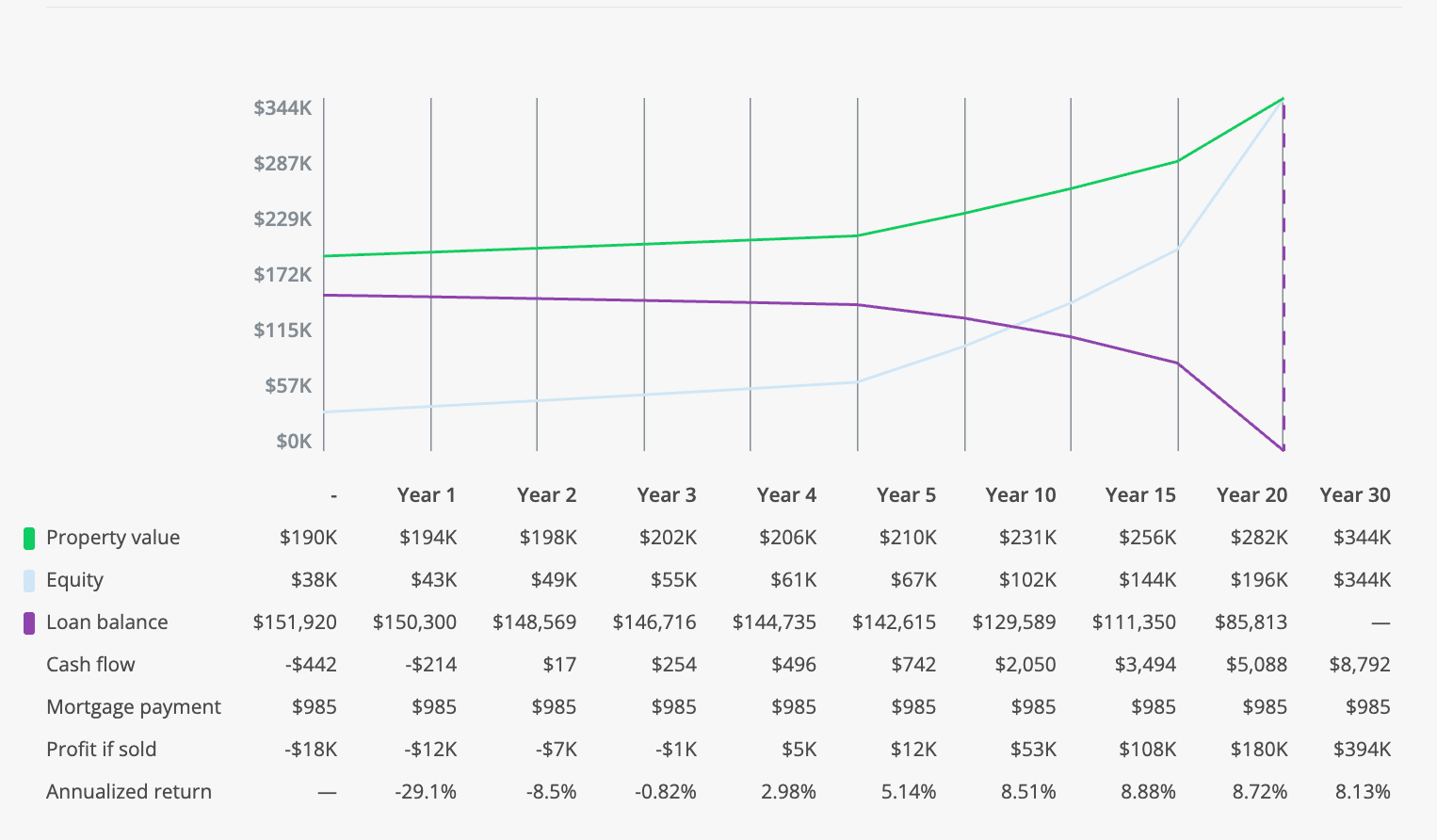

The Numbers »»

4737 Boulevard Place, Indianapolis, IN 46208

Single Family | 4 bed | 2 bath | 2968 sqft

$325,000

Why I Like it »»

Primed for Appreciation: 4 bed 2 bath, almost 3000 square feet, with a 2-car garage. Substantial asset that could easily be rented as a 5 bedroom.

Neighborhood Strength: Butler-Tarkington area benefits from student and young-professional demand.

Investor Angle: Long term wealth builder in a desirable neighborhood. Attractive on resale to investors and retail alike.

Cash flow neutral: Modest yield today, but long-term fundamentals and area strength make this a patient investor’s play.

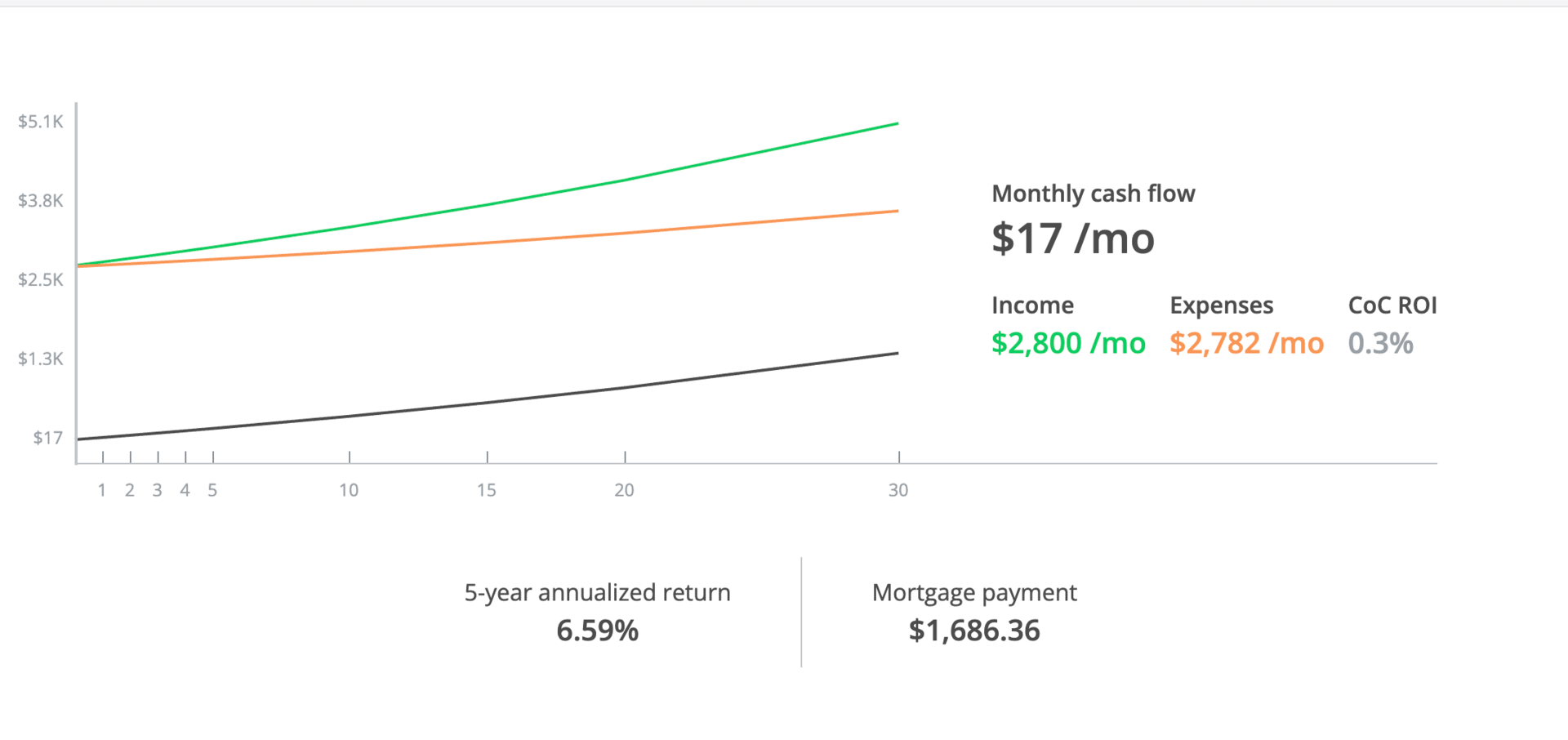

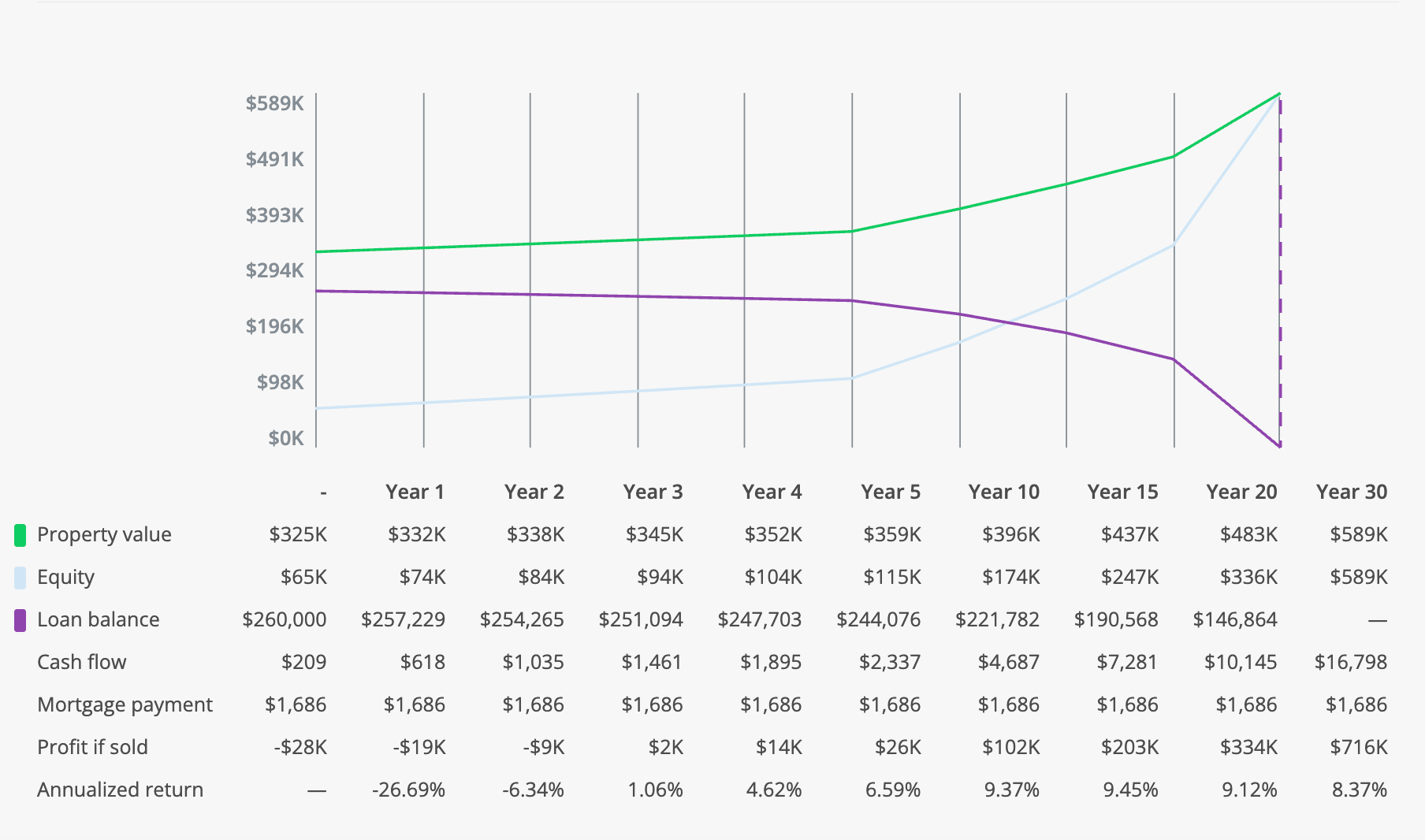

The Numbers »»

33 W 42nd St, Indianapolis, IN 46208

Single Family | 4 bed | 4 bath | 3700 sqft

$1,250,000

Bonus »»

Here’s one for my friends on the coasts. All the character, space, and location you dream of, right here in Indy. This beautifully restored Butler-Tarkington home blends historic charm with modern luxury, featuring original hardwoods, an open chef’s kitchen, and a detached office space above the garage.

It may not pencil out as a rental, but it’s proof that Indy luxury still costs less than a studio in San Francisco. :)

Market Snapshot

For this first issue, I thought it would be most fitting to start with a look at the current local market. There’s been plenty of talk about a changing national housing landscape, including median homebuyers now reaching a record 40 years old, spoiler alert, its not just new buyers being older, its older buyers being more common.

But national data only tells part of the story. Real estate is ultimately local, and Indianapolis remains in a stronger position than many markets, thanks to a stable job base, a lower cost of living, and below-average price per square foot for a major metro area. That said, Indy isn’t immune to today’s higher-rate environment or the broader rise in living costs. Let’s take a closer look at what’s happening locally by focusing on Marion County and the Downtown Indianapolis market.

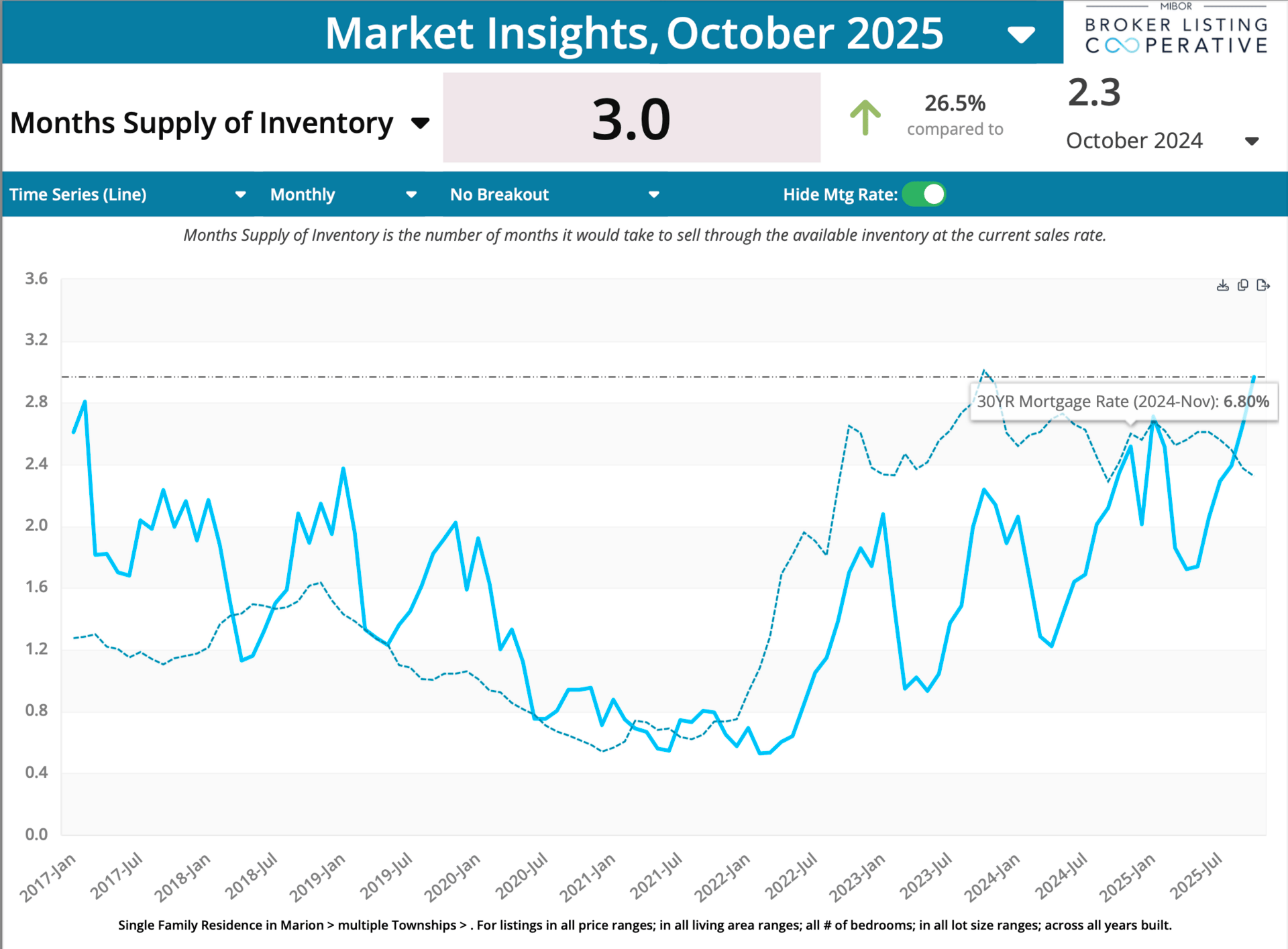

Inventory is up — leverage is shifting.

Months Supply of Inventory (MSI) sits around ~3.0 months, up ~26% year over year (≈2.3 → 3.0). More selection, fewer bidding wars, and stronger conditions for patient buyers and negotiators. For sellers, pricing to the market and condition is critical; stale listings will need price/credit strategies to compete.

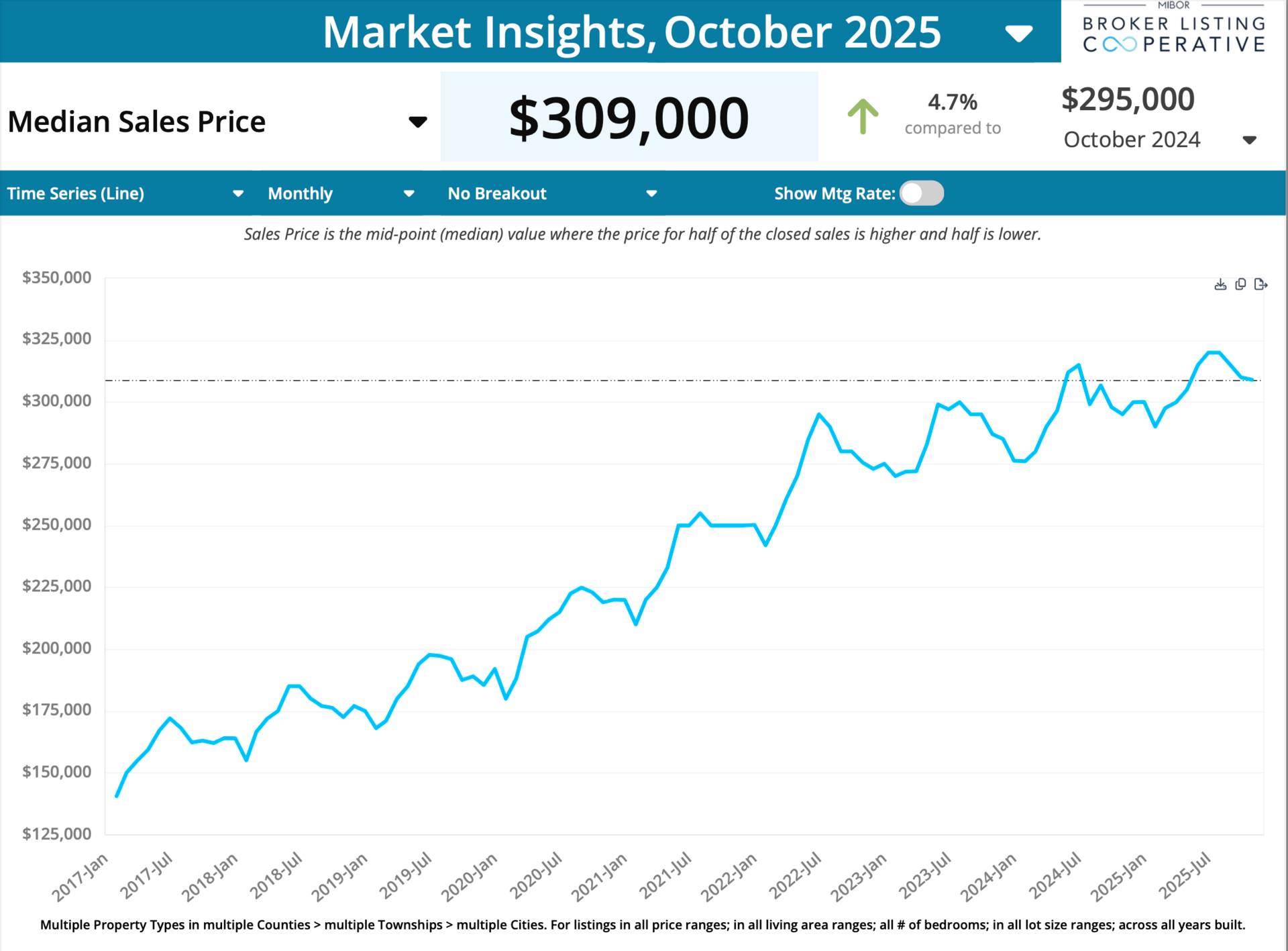

Prices are resilient — quality still commands a premium.

The median sales price is ~$309,000, up ~4.7% YoY (from ~$295k). This tells us that even with softer demand, well-located, turnkey homes are holding value. Distressed or dated properties can be bought with better terms, while renovated assets with stable rent comps still trade near ask.

Days on Market is climbing and winter is coming…

Median days on market is up ~18% YoY. Properties are sitting longer, creating room for inspection credits, 2-1 buydowns, and seller concessions — especially on homes with dated systems (HVAC/roof/electrical) or poor presentation. Smart buyers use this window to negotiate durability items and cash-flow enhancers.

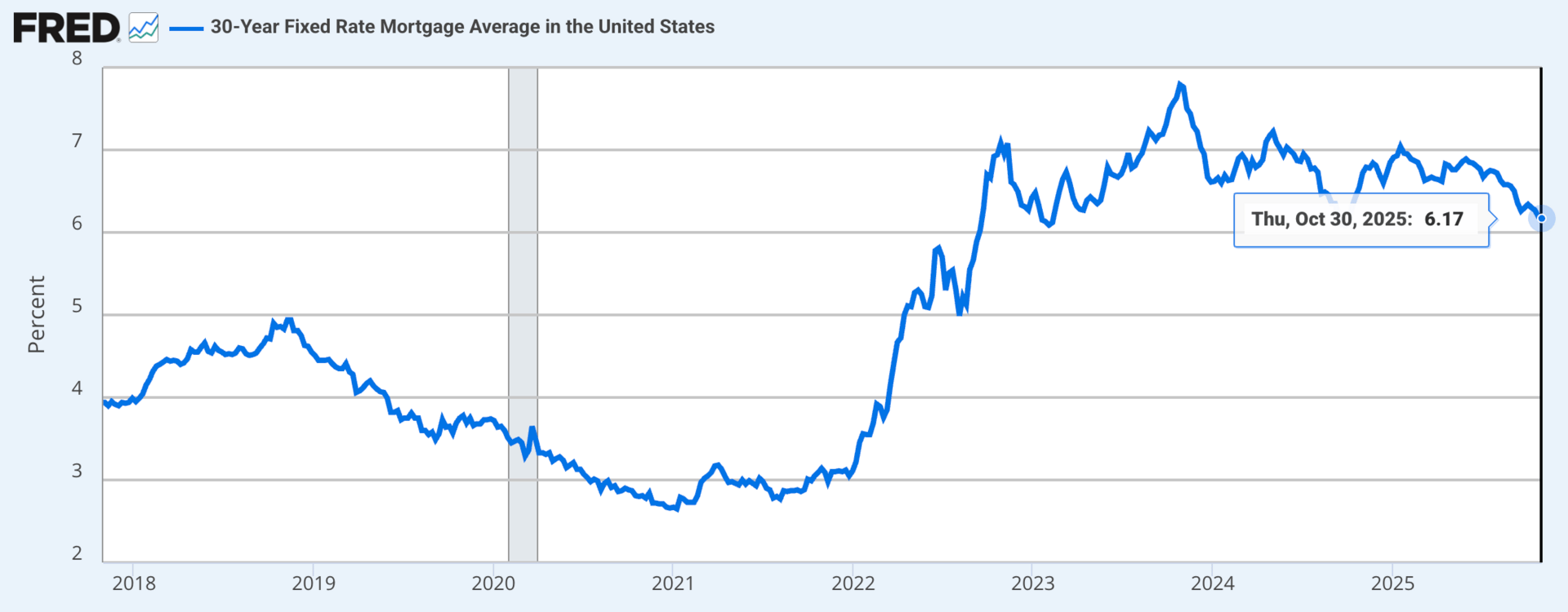

Rates & strategy

Rates remain elevated versus the 2020–2022 era, but sellers are increasingly funding buydowns and contributing to closing costs to bridge affordability. Investor playbook right now:

Underwrite conservatively (vacancy ~7%, capex ~8% of rents, rate shock +50–75 bps).

Ask for concessions to improve DSCR/cash-on-cash (closing credits, buydowns, seller financed home warranties).

Target rent-ready or lightly dated homes in strong rental submarkets; avoid “free” capex without price support.

Consider mid-term rentals where hospital/university demand is demonstrably durable.

If you made it this far I truly appreciate it. Please consider sharing with anyone you might think would be interested.

Do not hesitate to reach out at [email protected] or 831-206-9317, I would be excited to connect.

Have a great day!